BY JACK KWICIEN

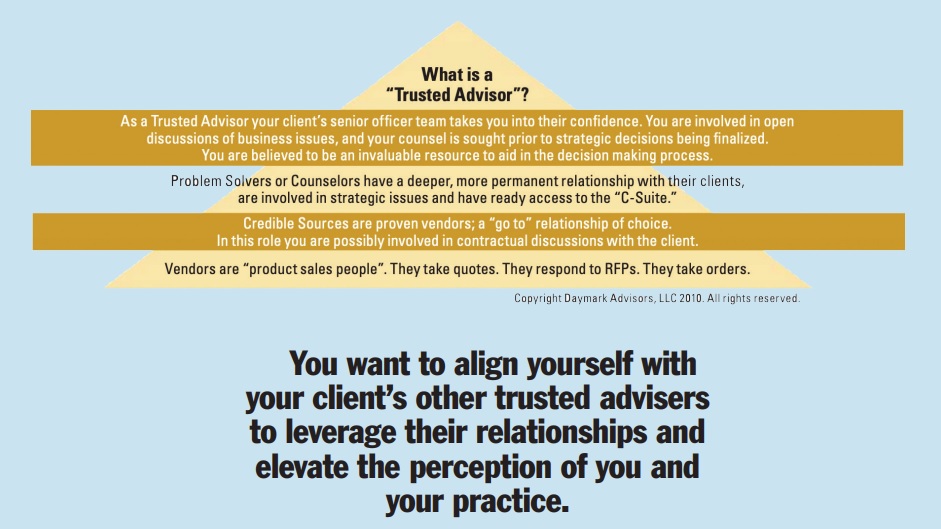

IN THE NOVEMBER ISSUE of Cal Broker, I talked about the pyramid of relationships and why you should want to aspire to be a “trusted advisor” for every one of your important client and business relationships. Just to refresh your recollection, the graphic succinctly illustrates the salient points.

So what kind of client relationships do you want? What actions will you take to move up the relationship pyramid? You really need to give this very serious thought since it will drive everything about your business and your future financial security. When contemplating your past results think about the clients that you have lost or the RFPs you were not successful in winning. What could have been done differently? It may have nothing to do with your technical knowledge about benefits or your insurance expertise. More than likely it had everything to do with the types of relationships that you had and the client’s perception of your value to their business.

So, what strategies can you and your team implement? These unprecedented circumstances require some creative, out-of-the-box thinking. It’s not business as usual. Let’s face it, your clients and prospects do not want to meet with you in-person. For that matter, you and your employees are likely working from home at least part of the week. So, where does that leave you?

Consider immediately developing a marketing and communications campaign to maintain regular contact with existing clients, prospective clients, and important business relationships. Elements can include:

- Twice weekly or weekly email campaign to your entire database providing updates, commentary on changes in laws, regulations and restrictions

- Regular blog content on pertinent topics that can be archived in a library on your website

- Periodic webinar series, including PPT presentations, regarding relevant issues such as cost-containment strategies, sources of business financing, best practices in HR, labor law concerns, new voluntary or lifestyle benefits, etc.

You may have to reach out to some of your important business relationships (attorney, accountant, banking relationship) and ask them to collaborate with you. That’s fine; they are in the same boat as you are right now anyway, and should welcome the opportunity to maintain positive contact with the marketplace. And they can include their clients in your campaign which can potentially lead to more business for your firm, as well for their organization.

How are you going to accomplish all this? Here’s a strategy that is easy to implement and that will deliver very positive results.

I’m not talking about approaching other professionals and saying, “Let’s share clients and prospects,” in a passive, pleading manner. I am talking about proactively developing a strategy to cultivate centers of influence with a stated purpose that will be mutually beneficial for both firms. At one of my conference presentations, an attendee said that this was a brilliant idea. I certainly appreciate the positive reinforcement, but the point is that this strategy works and has filled the sales pipelines of multiple firms over the years.

So, you say you want to expand your centers of influence, but you’re not sure where to start? I’ll give you one simple idea that’s easy to implement. Have someone on your team ask each current client as part of a survey for the name of the clients’ accountant, attorney and banking relationship. Why? Because those are your clients’ “trusted advisers” and that is how you want to be perceived. And you should know who their other advisers are anyway to coordinate discussions and to provide consistent, coordinated counsel.

You want to align yourself with your client’s other trusted advisers to leverage their relationships and elevate the perception of you and your practice. You don’t see those trusted advisers having their services evaluated on a spreadsheet do you? You don’t see them being replaced every few years based on price, right? That’s exactly the position you want to establish and you also want to be part of that “inner circle” peer group

Have the data from the survey arrayed on a spreadsheet to make it easy to analyze. It will be enlightening. You may find that you have 4 or 5 clients in common with one or more of the other advisers. That’s extremely valuable information. Won’t that be an easy call to set up lunch next week to explain what you have learned and to talk about strategies to enable both firms to make that 15 or 20 shared clients?

Offer to establish an educational seminar series that you will jointly present. Suggest that monthly or quarterly you invite your respective clients and prospective clients to an educational webinar that you will jointly present. Eventually, we will be able to get back to in-person seminar events. But for now, leveraging conference calls, webinars and video conferencing is essential to maintaining and expanding your market contact. Consider topics like: ACA compliance requirements; the intelligent integration of voluntary benefits to fill the gaps in an employer’s current benefits program; and creating a benefits strategic plan as a means for managing benefits decisions and benefits expenditures. These are terrific topics because you are educating your audience and differentiating yourself from 99% of all the other benefits brokers in your area.

Right now your clients and prospective clients have the time to spend learning new approaches to managing their business operations and they have a very active interest in hearing from a valuable and trusted advisor. You cannot be frozen like a deer in the headlights. It’s time to be proactive. Your business and family relationships are counting on you. Now more than ever before, you need to leverage telephonic and electronic communications to stay connected with your community. This is a winning strategy. I know, because we have helped any number of advisors over the years to create these kinds of communication campaigns, and that was long before the current pandemic. Consider that with the current change in working environment, you have a much more receptive audience to your message that also has time to absorb what you are communicating. And most of all, they need your advice and counsel. Step up and make a difference. Everyone will be better for it.

JACK KWICIEN, CLU, ChFC, registered investment advisor, is managing partner of Daymark Advisors, LLC (www.daymarkadvisors.com), a position he has held since co-founding the firm in 2001. He has over 40 years of executive management and entrepreneurial experience with specialization in business development, negotiating strategic alliances, financing transactions and mergers and acquisitions. Kwicien has significant experience in insurance, benefits and voluntary benefits. He is also the co-developer of the SMART Benefits Strategic Planning program (www.smartadvisors.biz).