A New Strategy for Fixed Index Annuities Helps Clients if Interest Rates Rise

A New Strategy for Fixed Index Annuities Helps Clients if Interest Rates Rise

by Kenneth L. Brown • There was speculation as we rounded the corner into 2012 that interest rates could start to rise this year. But, unfortunately, the optimistic thinking did not become reality.

How Brokers Can Take Annuity Products from Commodity to Specialty

by Mark MacGillivray • Changes to the annuities marketplace require many annuity brokers to participate in specific training on product features and take continuing education credits or even adopt a new sales approach.

Balancing COBRA and Medicare

by Harry P Thal • As with most things in American life, the government plays an important role. Health insurance is no exception. Along with the laws and regulations comes alphabet soup.

Is Long Term Care Insurance a Good Buy or is it Time to Say Goodbye?

by Jack B. Schmitz, CLU ChFC CASL • Products are a good buy. Low investment returns and competition for government funds are taking a toll on alternative LTC funding strategies.

It’s Time to Educate Your Clients About Multi-Life LTCI

Douglas Hamm • The lack of a long-term care program remains a major gap in our nation’s comprehensive health care reforms

Missing Link to Financial Planning: Life Insurance

by Ron Fields • Brokers should advise clients about the value and need for voluntary insurance that can provide the added protection that employees seek.

Our Annual Dental Survey – Part III

We’ve asked the top dental providers in California to answer 28 crucial questions.

Self-Funding Concepts for the Small and Mid-Size Market The Small Market Secret

by Johnny Scharnweber, CBC • Since many agents are not familiar with this opportunity, I’m going to explain this particular segment of alternative funding for the small market.

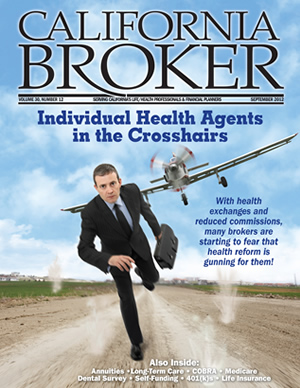

Individual Health Agents in the Cross Hairs

Are health exchanges gunning for them? Is it the end of the road?

by Leila Morris • Agents must get ready for the prospect of health insurance exchanges selling individual policies and medical loss ratio requirements driving down commissions. More people may buy insurance due to the individual mandate. However, many agents who sell individual policies are pessimistic.

Four Things Agents Need to Know About the Affordable Care Act

Robert R. Pohls, General Counsel • Insurance agents and financial advisors should recognize that they are uniquely qualified to help individuals and employers understand their obligations, evaluate their options, and develop a sensible plan for obtaining health insurance coverage on affordable terms.

COBRA Compliance – Top Issues for Employers

by Darrell Perkins • With all the new rules and regulations under health reform, fundamental and long-standing COBRA requirements still need to be addressed.

Retirement Plan Communication in an Auto-Features World

by Chuck Cornelio • The most recent solution in retirement plans is the introduction of automatic features including automatic enrollment, deferral, and escalation.

The Future of Retirement Savings

Redesigning defined contribution retirement plans to boost retirement readiness

by E. Thomas Foster Jr. •Some employers are starting to take a more proactive approach on promoting the importance of saving for retirement and making their defined contribution plans more effective and more relevant to the needs of today’s employees.

A New Strategy for Fixed Index Annuities Helps Clients if Interest Rates Rise

by Kenneth L. Brown

Historically low interest rates have been the hot discussion topic in the financial services industry in California and across the country for months. And recently, the question has been, “Just how low can they go?” There was speculation, as we rounded the corner into 2012, that interest rates could start to rise this year. But unfortunately, the optimistic thinking did not become reality.

Interest rates actually suffered a disappointing retreat, which has been particularly challenging for retirement savings options that are highly sensitive to interest rates, such as money market accounts and certificates of deposit (CDs). Traditional fixed annuity sales have struggled as well due to the continued low interest rates. In fact, total sales of fixed annuities dropped 10% in the first quarter, according to a report by LIMRA in April 2012.

There is some good news to LIMRA’s report on the annuity front: fixed index annuity sales were up 14% in the first quarter, outperforming traditional fixed annuities for the third consecutive quarter and capturing 45% of the fixed annuity market. It is fairly common knowledge that the popularity of income riders has driven sales growth, with guaranteed income emerging as a highly appealing feature to consumers. Financial professionals who are familiar with fixed index annuities were not surprised by the gains. This product category is appealing for clients who seek retirement income with a sound combination of interest-crediting flexibility and limited upside potential.

There is still a lot of confusion about fixed index annuities among financial professionals and clients in California. To help allay that, here’s a brief run-down on how fixed index annuities work: They give owners some interest-crediting potential, which is typically linked to the performance of one or more market indices. This is a big distinction from traditional fixed annuities. The owner can put all or some of the annuity’s value in the index crediting strategy and/or elect to allocate some portion to the fixed interest rate strategy that is typically offered. The owner benefits if the index performs consistently with the index crediting strategy. Yet, if the index goes down, a credit may not be received. However the owner’s principal is protected. And at every contract anniversary date, the annuity owner can re-allocate between the index and the fixed and index components of the product to seek a more appealing balance based on market conditions and personal preferences.

New Strategies That Latch Onto Rising Rates

There are willing buyers for fixed index annuities, as evidenced by LIMRA’s findings, yet many Californian financial professionals may still be wary and holding back. Interest rates on the fixed portions of these products have been disappointing. So why are people buying these products? Perhaps interest rates have been low for so long that these rates have become the new norm for many clients. Given this possibility, financial professionals must adjust their view of the interest rate hurdle and the potential sales opportunity that this product category represents.

The prospect of future rising interest rates is a major hurdle to sales of fixed annuities. It is hard to envision rates going any lower. Financial professionals and clients worry that rates will rise in the coming year or so, which makes it seem less attractive to commit now to a range of interest-rate-linked instruments, including fixed annuities.

Some insurers have introduced new features on their fixed index annuities to credit interest based on rising interest rates. Some carriers have explored using interest-rate-based crediting strategies that use a point on a published swap curve as the benchmark rate.

Another approach is a feature that provides the fixed index annuity owner with credit based upon an increase, if any, in the three-month London Interbank Offered Rate (LIBOR). The index strategy credits interest if the three-month LIBOR rises from one annuity anniversary to the next. To take advantage of this feature, clients need to have elected the strategy before interest rates rise. While we cannot predict the movement of future interest rates, it is reasonable to assume that interest rates could start to rise.

Here are the key aspects of the interest rate benchmark strategy:

• Upside Potential: If interest rates rise while the annuity owner’s funds are allocated to the interest rate benchmark strategy, the owner will earn a credit up to a cap, regardless of the performance of the equity markets during that contract year.

• Protected Principal: If the benchmark rate should drop during the contract year, the owner will receive no credit, but the annuity’s principal will be protected.

• Annual Floor Reset: The LIBOR value floor resets on each contract anniversary date, which means that the owner is in a position to accrue new credits based on interest rate increases, no matter what happened the previous year.

• Crediting Flexibility: The annuity owner is able to change the interest crediting elections on an annual basis based upon a new view of the equity and interest rate environment.

Index crediting strategies have a degree of diversification. Financial professionals can work with clients to find the right mix to adjust how much is allocated to the guaranteed rate, equity index, and interest rate benchmark, leveraging the annuity’s potential to act as a durable and flexible vehicle for retirement savings.

Debunking Annuity Myths

Myths about annuity products make clients leery and can make for a tough conversation, whether or not a fixed annuity – of any variety – may be a good fit for a particular client. A common myth is that fixed annuities have hidden fees and charges. Yet typically, there are no direct fees in the base fixed annuity. Financial professionals can dispel this myth, at the outset, in order to have a productive discussion with their clients. Generally, the only direct fees charged to a contract holder are optional features and benefits, such as guaranteed income or specific death benefits.

Another area of confusion involves surrender charges. Some California clients fear that they might face fees that would prevent them from accessing any of their funds if they needed them. In this case, a financial professional can explain to a client what surrender charges are, when they are incurred, and when money can be accessed without a surrender charge. For example, typically, an annuity owner can withdraw up to 10% of the annuity’s value in a given year without penalty. Additionally, many annuities follow the 10/10 rule, which limits surrender charges to 10 years and 10% in the first year of the annuity. Such charges diminish over time and completely disappear by the end of 10 years. Regardless of the 10/10 rule, of course, all surrender charges must be considered carefully in any situation in which a client is considering an annuity purchase.

Misunderstandings also arise when discussing limits on interest crediting in fixed index annuities, such as caps, spreads, and participation rates. Clients may think that such limits somehow boost profits for insurers. To allay this concern, a financial professional can explain that, generally, the insurance company purchases hedges to cover the cost of index credits that the annuity owner gets paid. Thus, the hedging strategy typically means that an insurer is not affected by the actual performance of the respective index and they don’t get a windfall, depending on the actual market performance or interest rate movement.

Moving Out Of the Wait and See Mode

Clients who take a wait and see approach now have a call to action with these new crediting strategies that may make a lot of sense for them. Sure, clients will still worry about stock market volatility and they express reluctance to lock into current interest rates, which may become unpalatable if rates rise in coming months. Clients may find fixed index annuities to be an appealing solution, including those with features that take advantage of rising interest rates.

It’s time to tell the real story about fixed index annuity options and address some of the negative myths that stand in people’s path. With some education and discussion of these new fixed index strategies that take advantage of rising rates, financial professionals can help their clients overcome their fear of the future and get back to saving for a more secure retirement.

–––––––––

Kenneth L. Brown is the vice president of Sales Development & Strategic Support for ING U.S. Insurance’s annuity and asset sales business, overseeing marketing, product development, regional wholesaling, sales training and development, and wholesale operations for the company’s annuity business. Before joining ING in 2005, Ken was the director of account management for CDS, a marketing and database management subsidiary of the Hearst Corporation.

Determine Suitability, Then Sell – How Brokers Can Take Annuity Products from Commodity to Specialty

by Mark MacGillivray

In 2010, the National Association of Insurance Commissioners (NAIC) adopted the updated Suitability in Annuity Transactions, Model 275. What followed were immediate and visible changes to the annuities marketplace – changes that require many annuity brokers to participate in specific training on product features and take continuing education credits or even adopt a new sales approach.

Nearly 30 states have adopted all or most of the NAICs new model regulation, which has added specific elements to the suitability requirements. The enhanced suitability rules have further emphasized the shift of annuity brokers from taking orders to being more involved in analyzing their client’s finances to better meet their needs.

Part of deviating from that commodity-based sales approach is analyzing the 12 suitability areas. This process allows a broker to gain important background information on the customer and assess suitability.

Evaluating suitability, 12 points at a time

As outlined in the NAIC model, a broker would perform a suitability analysis and collect information on 12 suitability areas:

1. Annual income: What does the customer’s financial situation look like from a monthly and annual perspective?

2. Age: Is the customer close to retiring or just starting to prepare for it? Age and stage of life matter and dictate which annuity product is the best fit.

3. Financial experience: A person with no financial experience almost always needs more help understanding the basics of investing.

4. Financial status: How much total debt does the customer have?

5. Intended use of the annuity: Each individual purchases an annuity for a different reason, with a different financial objective.

6. Financial objectives: Each individual is looking to achieve a different financial objective. For instance, ask if the customer is looking for a steady stream of income, long-term growth, or safety of principal and income.

7. Existing assets: Know which assets of a customer’s will be important in case they need to be transferred.

8. Financial time horizon: When does the customer want to accomplish their investment objective?

9. Liquidity needs: Can the customer convert their investments to cash without a substantial loss of principal?

10. Liquid net worth: Does the customer have enough liquid assets available after purchasing an annuity to cover both short- and long-term expenses?

11. Risk tolerance: Is the customer’s risk tolerance conservative, moderately conservative or aggressive? How much risk is the customer willing to take?

12. Tax status: Which status has the customer chosen when filing taxes?

Brokers collect the results from the suitability analysis and use those results as a reasonable basis to believe that the following points are true. Reason and results also inform and help in determining suitability. The consumer has been reasonably informed of the various features of the annuity, such as the following:

• Surrender charge period and amounts

• Potential tax penalties associated with a sale, exchange, surrender or annuitization of the annuity

• Expenses and investment advisory fees

• Features of and potential charges for riders

• Limitations on interest returns

• Insurance and investment components

• Market risk

• The consumer would benefit from the annuity’s features.

The annuity, as a whole, including any riders or product enhancements, is suitable for the consumer based on their suitability information. In the case of an exchange or replacement, the transaction, as a whole, is suitable.

An exchange or replacement (if applicable) is suitable taking into consideration the following, among other factors:

• Whether the consumer will incur a surrender charge or be subject to a new surrender period.

• Whether the consumer will lose existing contractual benefits.

• Whether the consumer will be subject to increased fees, investment advisory fees, or charges for riders and product enhancements.

• Whether the consumer will benefit from product enhancements and improvements.

• Whether the consumer has transacted another annuity exchange or replacement, and in particular, has had one within the preceding 36 months.

Now that brokers have the suitability process down, it is important to better understand each of the suitability areas. This article will dig deeper into these three areas:

1. Financial experience

2. Age

3. Liquid net worth

Determining a consumer’s financial experience sets the stage for the entire annuity planning process. If a consumer requires additional background and insight to make the right decision, a broker will know it up front. Additionally, the consumer’s age plays a key role in determining which type of annuity is most appropriate. Lastly, understanding the customer’s liquid net worth will provide a valuable understanding of a consumers entire financial picture.

Understanding The Customers Financial Background

Before any recommendations are given, one of the first pieces of information a broker must gather is the consumer’s financial experience. Financial experience is the knowledge that the consumer brings to the table to help determine, along with the broker, how specific financial instruments fit into an overall financial plan.

Clients with financial experience generally have a better understanding of investment basics. Those with less financial experience must rely more on the expertise of the broker and may need to take more time going over fundamental elements of annuities and financial planning.

Understanding the customer’s financial experience helps the broker know how much detail the customer will need in order to make an informed decision.

It will also identify the educational needs of the customer in order to make that informed decision.

A broker must also do their best to ensure that a customer makes an educated, informed decision. To do so, brokers must assess the financial experience of each customer and adjust their approach to making recommendations accordingly.

Applying Age and Stage Of Life

A customer’s age and stage of life can greatly affect the annuity product that a broker recommends. In many ways, a customer’s age contributes to their financial objectives and what they want and need from an annuity.

For example, individuals at retirement age generally have a lower risk tolerance. Often, these clients don’t want their savings exposed to potential market value fluctuations. At this age, clients highly value the concept of a guaranteed income for life and often look for products that offer minimum guarantees. In addition, consumers in this age bracket often need access to funds for various living expenses.

A single premium immediate annuity is often a good option for those in this stage of life. An immediate annuity guarantees payments, which start right away, for a specified time period or for a lifetime. This type of annuity is generally used as a way to generate periodic income payments. It is often used to convert accumulated savings into an income stream during retirement. Guaranteed income is important because many retirees will rely on their savings during working years to last a lifetime.

Another option for retirees is a fixed deferred annuity. Fixed deferred annuities offer tax-deferred growth in addition to principal guarantees and surrender-charge-free access to funds when qualifying events occur, such as a terminal condition or nursing home confinement. Numerous fixed deferred annuities meet these criteria. One thing to keep in mind is that the surrender charge period should not exceed the persons life expectancy.

Younger clients, who are still within their working years, are typically focused on making sure that they have sufficient funds when it is time to retire. To optimize their retirement savings, those in this age group should take advantage of certain tax-deferred investment vehicles, such as their employers 401(k), especially when they are getting free money in the form of an employer match. Once these investments are made and excess savings are still available, a fixed deferred annuity can be a viable offering because it combines safety with tax-deferred growth. A fixed deferred annuity is used primarily as a vehicle for accumulating savings and eventually distributing the value either as a payment stream or as a one-time, lump-sum payment.

Consider Liquid Assets

Brokers, not to mention state regulatory agencies, have an increased focus on client’s liquid net worth. Brokers must carry out due diligence to ensure a customer has enough liquid assets available after purchasing an annuity to cover long-term and short-term expenses. It is essential to learn if a customer has enough liquid funds to cover costs like daily living expenses or mortgage payments, as well as any money that might be needed for emergencies. Clients should not put all their liquid assets into an annuity.

State regulatory agencies are very interested in ensuring that a customer’s percentage of liquid assets used to purchase an annuity will still leave the consumer with sufficient liquid funds to handle unforeseen financial circumstances.

Carriers have often established parameters regarding the percentage of liquid assets they will accept for the customers purchase of an annuity. These parameters often fall within 25% to 40% of the customer’s liquid assets. These parameters are in place to help ensure a customer will not be left without funds should that customer lose their job or need to access emergency funds.

Find the Right Partner; Put the Wheels in Motion

With a provider’s help, an annuity broker can work through the 12 areas of suitability to help keep the financial planning focus on the customer. A provider will have the necessary tools and knowledge to help annuity brokers navigate and understand individual state regulations and therefore help determine suitability for clients. To help ensure that an annuity recommendation is compatible with the state’s suitability regulations, review the information with individual clients in mind and the state in which they do business.

Also, the right annuity provider will embody the following other qualities that help annuity brokers reach product suitability for their clients and offer support in other important areas:

• Financial stability: A provider must have financial stability. If the company goes under, the individual could lose their funds.

• Product mix: A provider should offer a variety of products so that annuity brokers can meet the needs of their clients.

• Crediting rates: It is important for an annuity broker to know the provider’s current interest crediting rates, which is equally as important as knowing the companys renewal rate history.

• Customer focus: A customer-centric provider is the key to a strong provider/broker relationship. Determine how easy it is to do business with the provider and what kind of information the provider will offer the annuity broker, including questions about its annuity products and how quickly clients can access funds.

With the support of a provider, annuity brokers can help clients embark on goal-oriented financial planning and better understand the types of annuities available to them including the one that suits them best. q

––––––––

Mark MacGillivray is a Regional Sales Director with The Standard. He has been working in the fixed annuity market for the past 17 years.

Balancing COBRA and Medicare

by Harry P Thal

Along with COBRA and Medicare laws and regulations comes alphabet soup. Many programs, created congress have become known by their acronyms. Some of the most common affecting health insurance are PPACA, HIPAA, and COBRA. And to not be out done by the federal government, California chimes in with Cal-COBRA.

First and foremost in the daily news is (PPACA), the Patient Protection and Affordable Care Act, commonly called ACA or ObamaCare. This controversial legislation has been upheld by recent Supreme Court rulings and is, therefore, the law of the land. The law is still contested by many and there is sure to be battles in more conservative states. But, for my purposes, I am going to press forward as if the law, as written, is what we must follow.

PPACA does come with a downside. All of the new benefit mandates have costs. These have been added to the monthly premiums. Almost all insurance companies are experiencing premium increases to offset the newly mandated benefits. And more are on the way. As of July, Californians will have maternity coverage added to their policies, even men and post-menopausal women!

PPACA has some other interesting characteristics that the consumer doesn’t see. One very controversial requirement is the Medical loss ratio (MLR). PPACA has determined that 85% of all group insurance premiums must be directed to medical care and 80% in the individual market. This leaves the insurance companies with 15% to 20% for all overhead. So far, this has had a minimal effect on customer service staffing and sales commissions have been reduced to meet this mandate. Insurance companies typically earn about 2% profit. What still remains a mystery is what is identified as a medical expense. Is the management of an HMO part of medical expense or administration? Time will tell as regulations are developed to administer this law.

While the states work to comply with PPACA, other letters in the soup are already part of our culture. COBRA, the Consolidated Omnibus Budget Reconciliation Act of 1984 is a federal law that requires insurance companies to continue health insurance benefits to workers and their covered dependents that are covered under their employer sponsored group plans after the worker terminates employment. This law applies to most businesses with 20 or more employees and exempts plans established by the federal government or churches that are exempt under section 501 of the Internal Revenue Code.

Dependent coverage is one of the key elements of this law. Each and every dependent who is covered under the group plan has the right to continue coverage. Therefore, if a worker retires at age 65 and goes on Medicare, the covered spouse and dependent children may remain on the group plan for the 18 months the COBRA law provides for. One comment I hear from people all the time is the high cost of COBRA. COBRA is not expensive. The monthly premium is what the employer has been paying all along for your coverage. There is a 2% billing service charge added on. That’s all! Many employees have no idea of the cost of benefits provided by their employer until they see the cost the employer had been paying.

In many instances, COBRA is used to continue insurance for inappropriate reasons. Typically it is laziness or not knowing that there may be more affordable coverage in the individual market.

Richard is retiring at age 65, leaving his 64 year old wife without coverage. While COBRA would be the answer if she could not qualify for an individual policy, Susan is a healthy person with no negative health history. She is able to buy any policy available. Since she is in good health and financially secure, she chooses a plan that is not as rich in benefits as the group plan, saving hundreds of dollars a month. She is covered if she does get sick or has a catastrophic accident or illness, and looks forward to her turning age 65.

What to do if you need coverage longer than 18 months or you work for a small business with fewer than 20 employees? California’s legislature stepped in and created Cal-COBRA, a similar bill to cover workers in the small group market. Companies with two to 19 employees fall under this law and provide similar continuation of the medical plan. Ancillary coverage, such as dental and vision, will probably not be covered, but the medical will. As previously stated, the consumer is now responsible for the full premium. In most situations the employer was paying for all or a great part of the monthly cost for the employee. In many situations, the employer may have paid for all or part of the dependent’s costs as well. Under COBRA and Cal-COBRA, the full cost of the coverage is born by the employee and covered dependents. COBRA does add a 2% administrative charge and Cal-COBRA a 10% cost.

When Cal-COBRA was enacted, it went beyond the federal COBRA legislation and provided coverage for the small employer (two to 19 employees) for 36 months. This allows the retiring person up to three years to find another position, or in many instances, wait for Medicare coverage. California law also provides for the larger employer’s terminated employee by allowing continued coverage under Cal-COBRA once the 18 months of federal COBRA runs out. This benefit is available to all covered dependents as well.

Dorothy and John get divorced. John will keep the children covered under his employer’s plan, but since Dorothy is no longer a dependent, she is no longer eligible as a spouse for continued coverage under the group plan. However, she is eligible to remain on the plan with identical medical coverage under COBRA and/or Cal-COBRA. She just needs to contact the human resources person or department at John’s employment. She will receive a new ID card and a bill each month for the next 18 or 36 months. If covered by the federal COBRA, she will need to connect with HR again in 18 months to transition to Cal-COBRA.

WARNING: COBRA and Cal-COBRA are not a substitution for Medicare. Once eligible for Medicare, you must enroll in Medicare. Do not wait past your Medicare eligibility and wait for the COBRA to run out. COBRA plans are not a substitute for Medicare, and when COBRA does run out, you will not be allowed to enroll in Medicare and will be charged a penalty (forever) once you are allowed to enroll as a late enroller. For Medicare purposes, since the employer is not paying for any part of the COBRA benefit, COBRA is considered as an individual plan. Therefore there is no special enrollment period for Medicare when coverage terminates.

Another set of letters in our alphabet soup may help consumers obtain health insurance; HIPAA.

HIPAA, the Health Insurance Portability and Accountability Act, will have different definitions, depending on whom you ask. Ask your doctor, therapist, lawyer, or banker, and they will tell you that it is a law that protects your privacy. Ask an insurance agent, and they will tell you that it guarantees you the ability to purchase health insurance even if you can’t medically qualify.

Samuel, who is 61, needed to retire early because his many medical issues didn’t allow him to perform on the job. He tried to get an individual health insurance policy when he first decided to retire, but he was unable to pass the medical underwriting requirements of the insurance plans he had applied for.

Sam needed to make his decision to elect his COBRA benefits within 63 days of the group plan’s ending. He went on COBRA and 18 months later is still unable to qualify, he took advantage of the Cal-COBRA law and continued his coverage.

Sam is now 64 and has run out his COBRA options, but still has close to a year to go before he qualifies for Medicare. He, once again, applies for an individual policy, and once again he can’t qualify medically to get accepted. His medical situation was such that the insurance company wouldn’t provide coverage, even at a higher rate. But, his health insurance agent advised him of HIPAA, which forces the insurance company to provide coverage. The insurance company must offer their two most popular selling plans to anyone who has exhausted the COBRA/Cal-COBRA benefit. The coverage must be without a break in coverage. Sam’s agent made sure that the individual health insurance application, which was rejected, stated that he wanted the HIPAA option if declined for regular coverage. Sam was offered a good plan at a costly price. As he is taking expensive medications, and really needs the coverage. He remained insured and awaits his turning age 65 and getting Medicare.

Beginning in October, 2013 most Americans will no longer need to worry about COBRA and HIPPA’s guaranteed issue since they will be able to purchase individual health insurance under the PPACA. These plans will be effective January 1, 2014. People who have financial difficulty paying for health insurance will have access to Federal assistance and will be able to purchase special health insurance policies offered by their states’ Health Insurance Exchange. Contact your local health insurance agent for more information.

–––––––––

Harry P. Thal, MA, is a licensed insurance broker in California (0621106) and other states. He is a member of the Society of Certified Senior Advisors, Past-President of the Kern Association of Health Underwriters and is on the National Assoc. of Health Underwriters (NAHU) Medicare Advisory Board. He is the recipient of the NAHU Golden Eagle Award. Harry is a Continuing Education instructor for Medicare issues with the California Association of Health Underwriters. He may be reached at 760-376-2100, e-mail harrythal@aol.com or visit him on the web at www.harrythal.com

Is LTC a Good Buy or is it Time to Say Goodbye?

by Jack B. Schmitz, CLU ChFC CASL

An attorney I met last year said she would never buy long-term care insurance (LTCI) for herself or her husband because it was not a good buy. I recently spoke with a couple whose financial planner advised them to drop their LTC policy because “she could do better” with the premium dollars. Neither of these couples had the assets to generate enough income to pay for the average monthly cost of LTC in their area, nor were they poor enough to qualify for MediCal without spending down hundreds of thousands of savings.

Insurance products are sometimes perceived as not a good buy because you spend your hard earned money on the premium and you may never receive anything in return. Paying insurance premiums and never receiving benefits is somehow perceived by many to be much worse than paying taxes for Social Security Disability or other government programs and never receiving anything.

Many LTC policyholders will get their premiums back in the form of reimbursements for eligible LTC expenses. According to the actuaries at DaVinci Consultants (they did some work for the CLASS Act program), half the people who buy a LTCI policy at age 65 and keep it in force, will use it if it has a 0-day elimination period.

With the most common 90-day elimination period, 36% will use their policy before they die. The 2012 to 2013 Sourcebook for Long Term Care Information reports that the average length of a claim has increased to 1,040 days. With $72,000 being an average number for the price of average care per year, a 1,040 day claim could cost just over $200,000. With healthcare inflation and increased demand, that number could quadruple over 30 years. For those who have cash flow and non-exempt assets between $250,000 and $5,000,000 or more, an advisor would be wise to leverage a small amount of insurance premium dollars into a large pool of LTC dollars.

A substantial amount of the LTCI policy premiums may be tax deductible and the benefits are usually tax free. Without LTC insurance, care might end up being paid with after-tax dollars. There is also the possibility of being surprised to end up in a MediCal bed on welfare, receiving the same type of care that could have been received in a private home. People who depend on the chronically ill financially or share financial resources with them, or who are otherwise emotionally and financially involved, might be surprised when $10,00 to $20,000 per month is withdrawn from assets to pay for care. Without LTC insurance, responsibility for the care and comfort of the chronically ill person becomes a bigger issue, with the burden being taken on unevenly in most cases. A long term care insurance policy can help alleviate family squabbles over the cost of care and who is providing it. Not having a policy could also result in having no advisor, no care coordinator, and no professional who is knowledgeable guidance readily available during a time of crisis.

We will be saying good bye to the current products as new products with new designs and rates are introduced. If you can still qualify for coverage, new coverage will have higher premiums for a similar potential payout. The longer you wait to buy, the higher your premium will be and the higher your probability of being declined will be as well. Underwriting is getting tougher for certain conditions as more claims data is developed. Blood test and family history will soon be used to decline more applicants. Premiums may increase as people live longer with chronic illness and claims become larger.

Say good bye to the current LTCI products, but don’t say good bye to your policy if you own one. Today’s products are a good buy for many when compared to other options. Low investment returns and competition for government funds are taking a toll on alternative LTC funding strategies.

In the future, the government may use means testing for welfare benefits, forcing more people to use previously exempt assets to pay for LTC. Filial responsibility may establish a family means testing requirement, placing an added burden on children of the chronically ill.

Today’s long term care insurance will be a good buy for those with assets that are not sufficient to provide a steady stream of income to pay for the care of a chronic illness or severe cognitive impairment. It will be a great buy for the 36+ percent who use it. If the premiums are a problem, consider a $100,000 to $250,000 starter plan to take advantage of your insurability and rates based on your current lower age.

––––––––––

Jack B. Schmitz, CLU ChFC CASL is with DI & LTC Insurance Services in San Rafael, CA 94903. He can be reached at 800-924-2294.

It’s Time to Educate Your Clients About Multi-Life LTCI

By Douglas Hamm

The Supreme Court upheld the Patient Protection and Affordable Care Act. But there is still a major gap in our nation’s comprehensive health care because there is no sustainable long-term care program. As a result of healthcare reform, businesses across the country will begin reviewing their insurance offerings and benefit packages over the next few months. This creates a unique opportunity for agents to educate clients about how adding multi-life worksite long-term care insurance (LTCI) solutions can help the bottom line.

Nearly six million U.S. employers represent mid-size workforces (those with fewer than 500 employees) making up more than half of all private-sector workers. About 70% of people will eventually need long-term care services in their lifetime; there has never been a more critical time for your clients to understand the multi-life LTCI options that are available for their workforce. Offering multi-life LTCI has great benefits for both employers and employees. Also, having more people privately insured can reduce the strain on the nation’s health care and Medicaid system. Unlike traditional group plans, multi-life LTCI plans are flexible enough for businesses of all sizes – even those with just a few employees – and program administration has never been easier. Before we discuss more of the benefits or challenges of employer-sponsored LTCI, it is important to fully understand the concept of long-term care.

What is Long-Term Care?

For a simple definition, just think care versus cure. Long-term care is needed when, due to a physical or cognitive disorder, a person is no longer able to care for themselves independently and needs ongoing assistance with activities of daily living, such as bathing, dressing, or eating without support or supervision. Therefore, long-term care generally focuses more on caring than on curing. In contrast, the general intent of health care is to restore health.

The majority of long-term care comes in the form of custodial care (helping or supporting someone perform activities of daily living) or supervisory care (providing significant supervision for a person who has a serious cognitive condition). A smaller portion of long-term care comes in the form of skilled care, such as care required from a nurse. Long-term care services may be provided in an individual’s home, in the community (adult day care), or in an assisted living or nursing home facility. LTCI can also be used for end of life services, such as hospice care. Costs of long-term care services in California can range from $51,000 annually for a home health aide, to nearly $94,000 per year for a nursing home stay with a private room, according to a recent Genworth survey. Looking at these figures, you won’t be surprised to learn that a majority of aging Americans are ill-prepared to manage the extensive costs. Additionally, many people fail to realize that government programs like Medicare and Medicaid will not fully meet their long-term care needs. Medicare only covers limited skilled care if it improves a person’s health condition. Also, no coverage is available for custodial care. Medicaid covers nursing home stays for poor and low-income citizens, which often requires a person to deplete their assets before qualifying for coverage.

Why Offer Your Clients LTCI?

The employer market is the fastest growing segment in the LTCI industry. Some mid-size employers may consider offering multi-life LTCI in response to employee demand or to increase employee recruitment and retention. Many valuable sandwich generation workers (adults who juggle the responsibilities of parents in need of assistance, as well as children still living at home), have experienced the challenges of caring for aging loved ones who were unable to prepare properly for long-term care needs. They want the opportunity to do better for themselves. Baby boomers make up about 26% of the population. It is not uncommon for businesses to have employees in this situation. Caregivers comprise much more of the workforce than most employers realize (about one in five, according to the AARP).

If your clients like to think of value in terms of dollars and cents, consider these costs:

• Businesses stand to lose up to $33.6 billion each year in lost productivity from employees’ need to care for aging loved ones.

• Employers pay 8% more for the health care of employees with eldercare responsibilities, which can cost an additional $13.4 billion per year.

• The average annual cost to employers per full-time caregiver is more than $2,100. LTCI can help employers offset some of these costs. In addition to post-retirement protection, many multi-life LTCI products offer immediate support in the form of care advisor services, which help employees manage the stress, demands, and workday distractions of caregiving. These services are designed to support, educate, and advocate for caregivers and their family members. These services also help the employer protect the interests and well-being of employees, as well as their own corporate outcomes. Multi-life programs can affect an employer’s bottom line as well. The following federal tax advantages vary by corporate status

• C-Corporations that contribute toward LTCI premiums can deduct 100% of all tax-qualified LTCI premiums as a business expense for all employees, spouses, dependents and retirees.

• S-Corporations can deduct a percentage of eligible LTCI premiums paid as a business expense.

Newer multi-life products can help small and mid-sized employers keep administration costs low, which is especially important as administration resources are typically limited.

What’s Keeping Employers Away?

If worksite programs offer obvious advantages both to employers and employees, why isn’t everyone jumping on the bandwagon? Surprisingly, most mid-size employers have not even been contacted about this benefit. It’s also important to remember that people can be misinformed about insurance products. Many employers don’t pursue LTCI for their employees due to mistaken beliefs about the challenges or barriers of LTCI, such as uncertainty about what the benefit offers, perceived administration complexity, and alleged high costs. In addition to being a great fit for both large and smaller businesses, many multi-life programs are also easy to set up thanks to streamlined processes. These include simplified underwriting, an abbreviated application process, and innovative web-based tools. Plan administration has also been simplified, which makes it easy for employers to oversee plans and access important information. As a producer, your role is to educate both employers and employees on why LTCI should be a cornerstone of their employee benefit offerings. That means sifting through the variety of products and plan options to find the best fit for your clients. A good worksite LTCI program offers a customizable plan for employers of all sizes. You need to find a product with the flexibility to suit an employer’s needs and deliver the best long-term value, such as employer-paid and voluntary, employee-paid offerings, add-ons (think inflation protection!), and varying levels of administrative support.

What’s Next?

It’s no secret that economic pressures have created a challenging environment in the LTCI market, forcing some carriers to make difficult business decisions. While the market may be adjusting, a number of carriers are committed to offering quality LTCI products and growing the industry. And the need for LTCI isn’t going anywhere. The SCAN Foundation offers the following statistics for California:

• By 2030, the number of Californians age 65 and older is projected to increase to almost 9 million, or 18% of the state’s population.

• The population of people 85 and older (those most likely needing LTC services) is expected to grow almost 40% by 2030 and 206% by 2050.

• The number of Californians age 65 and older with Alzheimer’s disease is expected to increase 38%, from 480,000 in 2010 to 660,000 in 2025.

It’s crucial for both employers and employees to understand the risks of not planning for long-term care needs, especially considering the growing demand for long-term care. For many mid-size employers, having a thoroughly researched and well-designed LTCI plan from a reliable carrier can be a smart way to provide valuable protection for both their employees and corporate goals. As an agent, it can help you find new opportunities in underserved markets and grow your book of business.

––––––––

Douglas Hamm, MBA, CLF, is vice president of Sales for LifeSecure Insurance Company LifeSecure’s insurance products are sold through a network of independent marketing organizations, brokers, and agents. For more information, e-mail dhamm@yourlifesecure.com or visit www.YourLifeSecure.com.

Missing Link to Financial Planning: Life Insurance

by Ron Fields

People work hard to establish a solid financial framework for themselves and their families with investments, home equity, savings plans, retirement accounts, and benefits. In many cases, a client wants to build a strong financial structure for the accumulated funds in order to provide for their family’s financial security well beyond the client’s death. But, like all good plans, best intentions can go awry if essential aspects of financial planning are not fully addressed.

Brokers should advise clients about voluntary insurance that can provide the added protection employees seek. Providing these benefits also helps create a robust, competitive benefit package at no direct cost to the company. With September’s focus on life insurance awareness, this is an opportune time for brokers to educate HR managers and business decision-makers about voluntary life insurance. The loss of a family member takes a toll on a family’s life emotionally. This difficult time can also create real financial challenges for the loved one’s survivors. From lost income and medical expenses to funeral costs and other accumulated bills and debt, the total financial impact can add up quickly. Brokers can help clients understand the value of educating employees about the real costs of death expenses. It will help provide families with peace of mind by planning ahead and investing in a life insurance policy.

With 35 million American households without life insurance, it is more imperative than ever for advisors to help workers understand their benefit options. Many consumers do not understand the complete scope of what is offered within a voluntary life insurance policy or the costly impact of choosing a benefit package without it.

What is a voluntary life insurance policy?

Many brokers provide voluntary life insurance policies to companies to help their employees take care of immediate and future financial needs incurred after a death. Primarily, these policies are available in two forms: term life insurance and whole life insurance. Premiums for term life insurance are fixed for a specified length of time. Premiums for whole life insurance remain the same for the policyholder’s whole life. Whole life insurance offers an investment option for funds that may be collected, borrowed, or used to pay policy premiums. This built-in cash-accumulation feature can help people pay off larger expenses, like a college education, a new car or a mortgage, allowing room for policyholders to settle debt and reach savings goals.

How does voluntary life insurance affect budgets?

A recent LIMRA study found that 34% of households admit they would immediately struggle to pay for everyday living expenses if a primary wage earner died today, underscoring how crucial life insurance coverage is for many workers.

In addition, the 2012 Aflac WorkForces Report found that 51% of workers are trying to reduce debt and 28% have less than $500 in savings for an emergency, reinforcing the importance of financial preparation for the passing of a loved one.

Family members are often left to cover both unpaid debts and new costs resulting from a death. Typical expenses include funeral bills, medical bills, and unpaid co-signed loans like those for mortgages, cars, or education. Current examples of the real cost of these expenses include the following:

• The National Funeral Directors Association found the average cost of a funeral is up to $7,755.

• According to LendingTree, the national average for a home loan is $222,261.3

• The average loan amount for a new vehicle is $25,995 and for a used vehicle is $17,050.4

What is the value of life insurance?

LIMRA research found that 12% of consumers did not buy life insurance because they could not decide what type or how much to buy. Ten percent were afraid to make the wrong decision and 8% did not know enough about life insurance to elect it. Brokers should advise HR managers and business decision-makers about the different forms of voluntary life insurance plans and how to tailor options to best meet each person’s needs.

The best time for workers to elect whole life insurance is when they’re young, while fixed premiums remain low. Whole life policies also increase their cash value over time. Since many employees cannot see the immediate benefits of a voluntary life insurance policy, it is important for brokers to highlight to employers the financial exposure workers and their families face without a policy.

Advisors should use compelling information to help employees make informed decisions about their benefit offerings. A LIMRA life insurance consumer study found that 60% of consumers do not recall being approached to buy voluntary life insurance in the last two years. In addition, 35% of shoppers who met with a sales representative did not buy voluntary life insurance because they said their sales representative failed to follow up with them.

With open enrollment season quickly approaching, this is an opportune time to help employers understand how essential it is to educate their workers about their benefit offerings, which will allow employees to make smart, cost-saving benefit choices for the coming year – decisions that could prove invaluable. Advisors should educate and promote the benefits and advantages of voluntary life insurance policies to help prepare workers for the unexpected. It will allow employees to rest easier knowing that they and their families are financially protected, even in the most difficult circumstances. Brokers and agents can elevate their status as a trusted advisor on strategic benefit decisions by giving employers the education they need to help workers make smart decisions on voluntary life insurance.

–––––––––

Ronald Fields is vice president of broker sales for Aflac. He is responsible for developing and strengthening relationships with national and regional brokers and accounts in the United States. He also oversees and coordinates the activities of Aflac market vice presidents, who are charged with increasing broker sales and market penetration in accounts with 500 or more employees. Visit aflacforbrokers.com, call 1-888-861-0251 or send an email to brokerrelations@aflac.com to learn more.

Tuning In To Our Annual Dental Survey–Part III

Welcome to Part III of California Broker’s 2012 Dental Survey. We’ve asked the top dental providers in California to answer 28 crucial questions to better help you, the agent, understand their benefits, features, and services. Read the responses and sell accordingly.

18. Do you provide coverage for all types of specialist referrals?

Aetna: Yes

Aflac: Aflac Dental does not require referrals.

Ameritas PPO and the FDH Networks: Yes, specialty coverage can be a part of any Ameritas plan designs. Our networks are comprised of a full-spectrum of specialists to cover the needs of our customers

Anthem Blue Cross: Yes, specialist care is available for both our Dental PPO and DHMO plans. No referrals are required on our Dental PPO plans, including Dental Prime and Dental Complete. On our DHMO plans, the member’s general dentist can refer them to a specialist when needed.

BEN-E-LECT: Specialist referrals are not necessary. Coverage is available for all types of specialty procedures including, but not limited to, endodontic, periodontic, cosmetic, orthodontics, oral surgery and pedodontics.

BEST Life: Yes, specialists are covered at full contract benefits as described in our Indemnity and PPO plan Certificates of Insurance. Our orthodontic plan is available for all of our PPO and Indemnity plans either at a deductible and lifetime maximum.

Blue Shield: Dental PPO/INO plan members may self-refer to any specialist, although INO members can only see network providers. For the dental HMO plan member there is no coverage for prosthodontic specialists.

Cigna: DHMO – Specialty referrals are not required for orthodontic treatment, if covered on their plan design or for pediatric care for children up to age seven as long as individuals visit network specialists. The network specialist may submit a request for pre-authorization to Cigna Dental for oral surgery and periodontal services. Individuals are responsible for the applicable patient charges listed on the Patient Charge Schedule for all covered procedures. After specialty treatment is complete, the individual should return to the network general dentist for care. If it is determined that a network specialist is not available, the general dentist will refer the patient to a non-network specialist and the patient will only be responsible for charges listed on the Patient Charge Schedule.

DPPO – Members may choose to seek service from any in- or out-of-network specialist or general dentist at any time. Of course, network dentists have agreed to our reduced fee schedules, which lower out-of-pocket expenses.

DEPO – Members can visit any network specialist or general dentist at any time to receive coverage.

Indemnity – Traditional indemnity members are always free to seek care from any licensed dentist at any time.

Delta Dental: Fee-for-service enrollees can self-refer; referral by the general dentist isn’t required. For DHMO enrollees, the primary care dentist is responsible for submitting the predetermination request and directing the enrollee to the appropriate specialist once authorization is received.

Dental Health Services: Our plans provide specialty coverage for endodontics, periodontics, oral surgery, pedodontics, and orthodontics.

Guardian: We provide coverage for all types of dental specialists.

Health Net Dental: For DHMO plans that require pre-authorization, the contracting primary care dentist completes a specialty referral form and submits to Health Net Dental. Approvals are returned to the primary care dentist, member and specialist. Upon receiving the approval, the member contacts the specialty office to schedule an appointment for completion of treatment. For plans that have direct referral, the primary care dentist may directly refer the member to a participating specialist by visiting our Website or by contacting our customer service.

Humana: Fee-for-service reimbursement encourages thorough treatment. Member complaints are reviewed by our Quality Assurance Department and through our standard grievance process.

MetLife: For Dental PPO, claims for services by licensed dental practitioners will be considered for reimbursement based on the participant’s plan design. For Dental HMO/Managed Care, the SGX and MET Series of Dental benefit plans have co-payments and/or covered percentages for endodontics, periodontics, oral surgery, pedodontics, and orthodontics services provided by a participating specialist.

Principal Financial Group: Generally yes.

Securian Dental: Our plans do not require referrals. We provide coverage based on plan benefits.

United Concordia: Our PPO plans do not require specialist referrals. Our DHMO plans require referrals for specialty coverage for endodontics, periodontics, pedodontics, oral surgery, and orthodontics. The services provided by specialists that are considered for benefit reimbursement are limited to the specifics of the dental contract for each covered member.

Western Dental: Specialty coverage is available in all of our group plans. Oral surgery, periodontics, endodontics, pedodontics, and orthodontics are covered specialties.

19. If covered, explain the process that allows the general dentist to refer to the specialist.

Aetna: For DMO plans, general practitioners can refer to a participating specialist directly based on published guidelines. DMO members have direct access to participating orthodontists and do not need a specialty referral. Indemnity and PPO plans have direct access for specialty services.

Aflac: Aflac Dental does not require referrals.

BEN-E-LECT: Referral is not necessary for any of BEN-E-LECT’s plans. The member may select a specialist and schedule an appointment upon making a phone call or personal visit.

BEST Life: No referral is necessary. Insureds can visit a specialist at any time.

Cigna: DHMO: Network general dentists initiate patient referrals for endodontic, oral surgery, and periodontal treatment. Referrals are confirmed for 90 days from the approval date. Specialty referrals are not required for orthodontic treatment or pediatric care for children up to seven years old, as long as members visit network specialists. The network specialist may submit a request for preauthorization to Cigna for oral surgery and periodontal services. Members are responsible for the applicable patient charges listed on the patient charge schedule for covered procedures. After specialty treatment is finished, the member should return to the network general dentist for care. If a network specialist is not available, the general dentist will refer the member to a non-network specialist, and the member will only be responsible for charges listed on the patient charge schedule. However, Cigna Dental Care (DHMO) network general dentists render the range of services that are required for graduation from dental school, including diagnostic treatment, preventive treatment, operative dentistry, crown and bridge, partial and complete dentures, root canal therapy, minor oral surgery, preliminary periodontal therapy, and pediatric dentistry.

DPPO: There is no need for a referral by a primary care dentist to obtain services from a specialist with the Cigna Dental PPO plan. Members may choose to seek service from any in- or out-of-network specialist or general dentist at any time. Of course, network dentists have agreed to our reduced fee schedules, which lower out-of-pocket expenses

DEPO: There is no need for a referral by a primary care dentist to obtain services from a specialist with the Cigna Dental EPO plan. Members can visit any network specialist or general dentist at any time to receive coverage.

Indemnity: Cigna Traditional indemnity members are always free to seek care from any licensed dentist at any time.

Delta Dental: Fee-for-service enrollees can self-refer; referral by the general dentist isn’t required. For DHMO enrollees, the primary care dentist is responsible for submitting the predetermination request and directing the enrollee to the appropriate specialist once authorization is received.

Dental Health Services: The general dental office sends Dental Health Services a specialist referral authorization. Upon approval, the authorization is sent back to the general dentist who informs the patient that they are now eligible to get appropriate care from a specialist

Guardian: For the DHMO plan, any complex treatment requiring the skills of a dental specialist may be referred to a Participating Specialist Dentist. Our DHMO plans offer Direct Referral in which the member may be referred directly by their primary care dentist to a participating specialist without pre-authorization.

Health Net Dental: For DHMO plans that require pre-authorization the contracting primary care dentist completes a specialty referral form and submits to Health Net Dental. Approvals are returned to the primary care dentist, member and specialist. Upon receiving the approval, the member contacts the specialty office to schedule an appointment for completion of treatment. For plans that have direct referral, the primary care dentist may directly refer the member to a participating specialist by visiting our website or by contacting our customer service.

HumanaDental: General dentists are encouraged to refer members to participating specialists to provide the highest level of benefit to the member. The general dentist can refer out-of-network if there are no specialists within a reasonable distance

MetLife: Our Dental PPO product does not require referrals for specialist care. For Dental HMO/Managed Care, the SGX and MET series of Dental benefit plans allow participating general dentists the flexibility to refer members to participating specialists without prior approval – except for orthodontic and pedodontic specialty services in CA where the member’s selected general dentist will contact us for pre-approval.

Principal Financial Group: Patients can choose any provider in the network; referrals are not required.

Securian Dental: No referral is required.

United Concordia: If a general dentist determines that a patient requires referral to a specialist, all care must be coordinated through the primary dental office. The primary dental office should refer the patient to a participating specialist located in our Concordia Plus Specialist directory and also complete the Specialty Care Referral Form. The patient should be given a copy of the referral form to give to the specialist at the time of their appointment. The specialist will then be responsible to submit the claim, corresponding documentation and referral form to United Concordia for reimbursement.

Western Dental: Once the general dentist determines that the necessary procedure is out of his or her scope of practice, the office will submit a written referral request to our plan. Western Dental’s dental director then determines whether the referral is medically necessary and whether the procedure is covered under the benefit plan.

20. Are any of your specialists board eligible/certified?

Aetna: Yes

Aflac: For benefits to be payable, the specialist must be licensed by his or her state to perform the required treatment.

BEN-E-LECT: Yes. BEN-E-LECT requires that all participating specialists be board certified.

BEST Life: All of our specialists are certified and must meet a rigorous credentialing process to be included in our network. Before a specialist can join our network, we require a license to practice, DEA/CDS certificates, Education/Training including Board Certification, work history, malpractice insurance, malpractice claims history, hospital privileges, sanctions against their license, Medicare/Medicaid sanctions, and perform ongoing monitoring of sanctions or regulatory actions. All providers must go through the credentialing process every three years.

Cigna: Yes, all network dentists contracted to provide specialty care have successfully completed post-graduate dental specialty programs in their fields. Cigna’s dental networks include specialists in periodontics, orthodontics, endodontics, pediatric dentistry and oral surgery.

It is important to note that in dentistry, board certification is not the norm. As a result, we do not require this item for credentialing. We accept dentists who are recognized specialists, including those who are board certified or board eligible.

Delta Dental: Delta Dental requires board certification where it is required by state law. Under the fee-for-service plans, Delta Dental credentials all of its participating specialists in the same manner, whether they are board-eligible or board-certified. Under the DHMO plans, Delta Dental requires all DeltaCare USA network specialists to be board-qualified.

Dental Health Services: The majority of our dental specialists are board certified.

Guardian: Many of our PPO specialists are board certified or eligible and all of the DHMO specialists are board-eligible.

Health Net Dental: Yes.

HumanaDental: All participating specialists must provide copies of their specialty licenses or residency certificates.

MetLife: In order to participate with the Dental PPO or HMO/Managed Care, specialists must submit and keep current any certifications and/or other factors necessary to maintain their specialty.

Principal Financial Group: Yes. All specialists are required to be board-eligible, board certified or be a designated specialist by the ADA.

Securian Dental: 100% of the specialists in our network are board certified or board eligible.

United Concordia: Yes, as part of our credentialing process, we verify each dentist’s education, license and certifications.

Western Dental: All contracted specialists are board-eligible/certified.

21. How do you fund your specialty care?

Aetna: Specialty services are paid on a fee–for-service basis.

Aflac: Aflac Dental insurance* pays a set amount per procedure based on a table of allowances. Additionally, policyholders have the freedom to choose their own provider without precertification. *Policies may not be available in all states. Benefits are determined by state and plan level selected. Refer to the policy for complete details, limitations, and exclusions. Coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, coverage is underwritten by American Family Life Assurance Company of New York

BEST Life: Specialty care is built into the premium. Specialty care received by a network provider is reimbursed at a discounted fixed fee schedule. Specialty care received by a non-network provider is reimbursed on what is usual and customary for that area, procedure and specialty

Cigna: DHMO and DPPO specialists are compensated similarly through discounted fee-for-service, which is paid from a portion of the overall collected premiums.

Delta Dental: Specialty care is built into the premium. Under the fee-for-service plans, specialists are reimbursed by a combination of maximum plan allowances by procedure (contracted fees between Delta Dental and dentists) and coinsurance paid by the covered enrollee. Under the DHMO plan, network specialists are reimbursed for preauthorized services on a per claim basis according to contracted fee schedule and co-payment paid by the enrollee.

Dental Health Services: Specialty care and treatment is paid for on a contracted basis and payment varies by procedure. These costs are built into each plan’s monthly premium rate.

Guardian: Our PPO specialists are paid on a fee-for-service basis. For our DHMO plans, specialty care is funded through a portion of premium.

Health Net Dental: For our DHMO and DPPO plans, we underwrite and rate dental plans based on an assumed specialty care claims liability and build an allowance into our dental premiums.

HumanaDental: Specialists are paid on a fee-for-service basis according to a contracted fee-schedule amount or by reimbursement limit.

MetLife: For Dental PPO and HMO/Managed Care, specialists are reimbursed based on a predetermined fixed fee schedule. The SGX and MET Series of dental plans have co-payments and/or covered percentages for specialty services – listed on the Schedule of Benefits for the plan.

Principal Financial Group: Through normal plan provisions.

Securian Dental: Network dentists (general and specialty dentists) are reimbursed on the basis of a discounted fixed fee schedule. Network dentists agree to accept the fee schedule amount as full consideration, less applicable deductibles, coinsurance and amounts exceeding the benefit maximums and will not balance bill the member.

United Concordia: To fund specialty care, we use standard transfer business techniques to create group rates for new business and client-specific experience for existing business. As such, United Concordia requires claims experience when determining rates for clients with at least 200 enrolled contracts. United Concordia adjusts the prior carrier’s client-specific experience for assumed changes in-network utilization and payment levels, changes in benefits and utilization review, and projects it to the proposed policy period. We then add required administrative expenses and margins to create the required premium.

If prior carrier experience is not available, we actuarially create rates using client-specific demographics, including plan design, geographic location, prior carrier history, expected participation, and industry.

Western Dental: We incorporate into our premiums what we expect specialty care claims to be. We then pay the claims based on dental necessity and plan guidelines.

22. Does the member have to be referred by the primary dentist to the orthodontist or can he or she self-refer?

Aetna: The member can self-refer.

Aflac: Aflac Dental does not require referrals. Policyholders may self-refer.

BEN-E-LECT: Members may self-refer to any orthodontist they prefer. In-network versus out-of-network and plan selection will determine coverage provided.

BEST Life: No referral is necessary on our PPO or Indemnity plans.

Cigna: None of our plans require a referral for orthodontic care.

Delta Dental: Under the fee-for-service plans, enrollees can self-refer. For DHMO plans, the assigned network dentist submits a referral request for orthodontic treatment to Delta Dental. The network dentist is notified upon approval and is responsible for advising the DeltaCare USA enrollee who then contacts the assigned network orthodontist for an appointment.

Dental Health Services: Members must get a referral from one of our network dentists before visiting a participating orthodontist.

Guardian: PPO members can self-refer to all types of specialty care, including orthodontia. General dentists in our DHMO network will refer the member to a Participating Orthodontist. The referral does not require plan authorization.

Health Net Dental: Our DPPO product does not require referrals for specialty or orthodontic care, so participants may self-refer. For DHMO, there are three types of specialty referral processes based on the member’s schedule of benefits. For plans that require pre-authorization, a specialty referral form must be submitted by the primary care dentist. For plans that have direct referral, the primary care dentist may directly refer the member to a participating orthodontist by visiting our website or by contacting our customer service. For plans that allow self-referral, the member may go directly to a contracted specialist by visiting our website or by contacting our customer service.

HumanaDental: In our PPO, the member can self-refer to an orthodontist.

MetLife: Our Dental PPO product does not require referrals for specialty or orthodontic care, so participants can self-refer. For Dental HMO/Managed Care in CA, orthodontic specialty services require pre-approval. The member’s general dentist will contact us for pre-approval, and once approved will contact the member with the name of a participating orthodontist.

Principal Financial Group: A member can choose to seek services from any provider.

Securian Dental: The member can self-refer.

United Concordia: Our PPO plans allow members to self-refer. Under our DHMO plans, the primary dentist determines if a specialty referral is required, regardless of the specialty.

Western Dental: The member has to be referred by the primary dentist to the orthodontist for our IPA Dental Plan. Our Western Centers-only plan allows the member to self-refer.

23. What is the time frame for processing a referral in terms of member notification and payment to the specialist?

Aetna: DMO general practitioners usually provide a member with an immediate referral. Specialty payments are made on receipt and adjudication of the claim.

Aflac: Aflac Dental does not require referrals because policyholders have the freedom to choose their own dentist without restriction.

BEN-E-LECT: Referral is not necessary. Members may call and schedule the appointment as desired.

BEST Life: No referrals are required on our Dental PPO/Indemnity plans.

Cigna: For the DHMO, typical turnaround time for specialty referrals is five days for pre-authorization and five days for payments.

Delta Dental: For fee-for-service patients, specialty care referrals are not required and payments to specialists are processed the same as for general dentists. In 2011, the average time for processing predeterminations was five days. For DHMO enrollees, preauthorizations for specialty care processed within five business days.

Dental Health Services: Emergency referrals are processed immediately. In a non-emergency situation, referrals are processed within one to two weeks. Claims are paid within two to three weeks.

Guardian: Referrals are not required under our PPO plans. For our DHMO plans, payment to the specialist is within 30 days of receipt of the claim.

Health Net Dental: The average turnaround time in processing a non-emergency referral is 48 hours and then seven to 10 business days for the EOB to be received by the member. Once the claim is submitted by the specialist, our average turnaround time in processing is 10 business days of receipt and then seven to 10 business days for specialists to receive payment in the mail. If the claim was sent electronically, it will be sooner.

HumanaDental: Most HumanaDental plans do not require a referral from a general dentist to a specialist. The member gets a higher benefit when seeing a participating dentist and specialist. In 2008, 85% of claims and 97.4% of referrals were processed within 14 calendar days.

MetLife: For Dental HMO/Managed Care, standard referrals are processed in an average of five business days for member notification and 14 business days for payment to the provider. Our Dental PPO product does not require referrals for specialty or orthodontic care

Principal Financial Group: N/A

Securian Dental: No referral is required.

United Concordia: All referrals are immediately effective. The member is instructed to provide the referral to the specialist at the time of service and the specialist files the referral with the claim. All claims, including specialist claims, mailed to United Concordia are usually processed within 14 days. Claims filed electronically are processed immediately with payment rendered during the weekly check writer cycle

Western Dental: Emergency referrals are handled within 24-hours. The turnaround for non-emergency referrals is three business days. Specialists can expect payment in 10 business days for clean claims

24. If you limit services with an annual or lifetime maximum, what does the maximum dollar amount allowed refer to?

Aetna: The maximum dollar amount refers to the total amount Aetna will pay for covered benefits.

Aflac: The annual maximum refers to the maximum amount of benefits that may be received within a policy year per covered person. Annual maximums do not apply to wellness and X-ray benefits.

BEN-E-LECT: The maximum dollar and lifetime maximum refers to all services and procedures unless specified otherwise by benefit.

BEST Life: Lifetime maximum applies to orthodontia benefits. BEST Life offers multiple choices of calendar year maximums for preventive, basic and major procedures

Cigna: For DHMO: There is no annual or lifetime maximum; For DPPO/DEPO/Dental indemnity: The maximum dollar amount refers to the maximum amount payable by Cigna for covered services rendered.

Delta Dental: Under the fee-for-service plans, the maximum dollar amount refers to the maximum dollar amount paid by the plan. Our DHMO plans do not have annual or lifetime maximums.