CLICK HERE TO READ INSIDER ONLINE

Congratulations employee benefits pros!

Employers Wisely Avoid Benefits Cuts Despite Predicted 2023 Cost Increases

SHRM reports employers in the U.S. expect medical plan costs per employee to rise 5.6 percent on average in 2023, according to HR consultancy Mercer. While significantly higher than the premium increase of 4.4% expected for 2022, the 2023 increase lags overall inflation, which is currently running at about 8.5% year over year. Despite rising costs, most employers are not planning to increase employees’ share of coverage costs in 2023, such as by raising deductibles or co-pays, Mercer reported.

[Editor’s note: THIS indicates BROKERS have done a good job of recommending alternatives to straight cost shifting.]

“Because health plans typically have multiyear contracts with health care providers, we haven’t felt the full effect of price inflation in health plan cost increases yet,” said Sunit Patel, Mercer’s chief actuary for health and benefits.

The effect of higher health care prices on plan costs “will be phased in over the next few years as contracts come up for renewal and providers negotiate higher reimbursement levels,” he said. “Employers have a small window to get out in front of sharper increases coming in 2024 from the cumulative effect of current inflationary pressures.”

Read full article here by Stephen Miller, CEBS for SHRM (SEE ABOUT Quarterly)

HEALTH BENEFITS

No Surprises Act Prevented 9 Million Surprise Bills

As many as 9 million surprise medical bills have been prevented since January due to the impact of the No Surprises Act, according to new data published by AHIP and the Blue Cross Blue Shield Association. The number of those claims disputed by providers or facilities has far exceeded the federal government’s initial prediction, the survey found.

The law establishes a process for resolving disagreements on what the health plan will pay the out-of-network provider or facility, culminating in independent dispute resolution (IDR). However, providers who previously were able to balance-bill patients may now be using the IDR process to collect above-market reimbursement.

Dive deeper: HEALTHCARE FINANCE

Good NEWS! The LONG VIEW

Deloitte Predicts Health Spending As Percentage of GDP Will DECELERATE Over Next 20 Years

Deloitte health actuaries project a deceleration in health spending, likely creating a US$3.5 trillion “well-being dividend” by 2040. Explore what the future of health could look like — a dramatic transformation driven by new business models, emerging technologies, and highly engaged consumers. Read details here.

The SHORT VIEW: 2023 Cost Increases 6.5%

Aon: U.S. Employer Health Care Costs Projected To Increase 6.5 Percent Next Year

Strategy: Improve Outcomes and Costs by Addressing Complex Conditions

- Forecast: Average Health Care Cost per Employee Rising to $13,800

The average costs that U.S. employers pay for their employees’ health care will increase 6.5% to more than $13,800 per employee in 2023, up from $13,020 per employee in 2022, according to professional services firm Aon.

Faced with the constant, upward pressure from health care trends each year, employers are exploring new solutions to trim their health care costs. One worthwhile approach is to address the high costs associated with patients with chronic and complex health care conditions. Dive deeper here.

TOOLS FOR 2023 PLANNING

Forbes: What Are The Keys To 2023 Planning In The Midst Of Uncertainty? Discipline and Precision

Companies should prioritize investments that maximize revenue growth, profitability, resilience

In spite of the reality of global unrest and instability, soaring inflation and a predicted economic slow down, a recent Forrester survey of U.S. business leaders found that many are holding on to optimism. Most expect at least some increase in overall spending next year, while many also anticipate spending more on talent and technologies. Lessons from early in the pandemic, when investments in digital innovation paid off while blunt, cross-the-board cuts did not, have clearly taken hold. Yet 2023 will not be 2020 — and will require a different tack.

Take a surgical approach to planning

The best way out of a downturn is indeed to continue investing — but only if you pick the right areas. Forrester’s 2023 Planning Guides provide detailed guidance for technology, customer experience, digital, marketing, sales, and product leaders on where to invest, where to pull back, and where targeted experiments might pay off. Find the guides here.

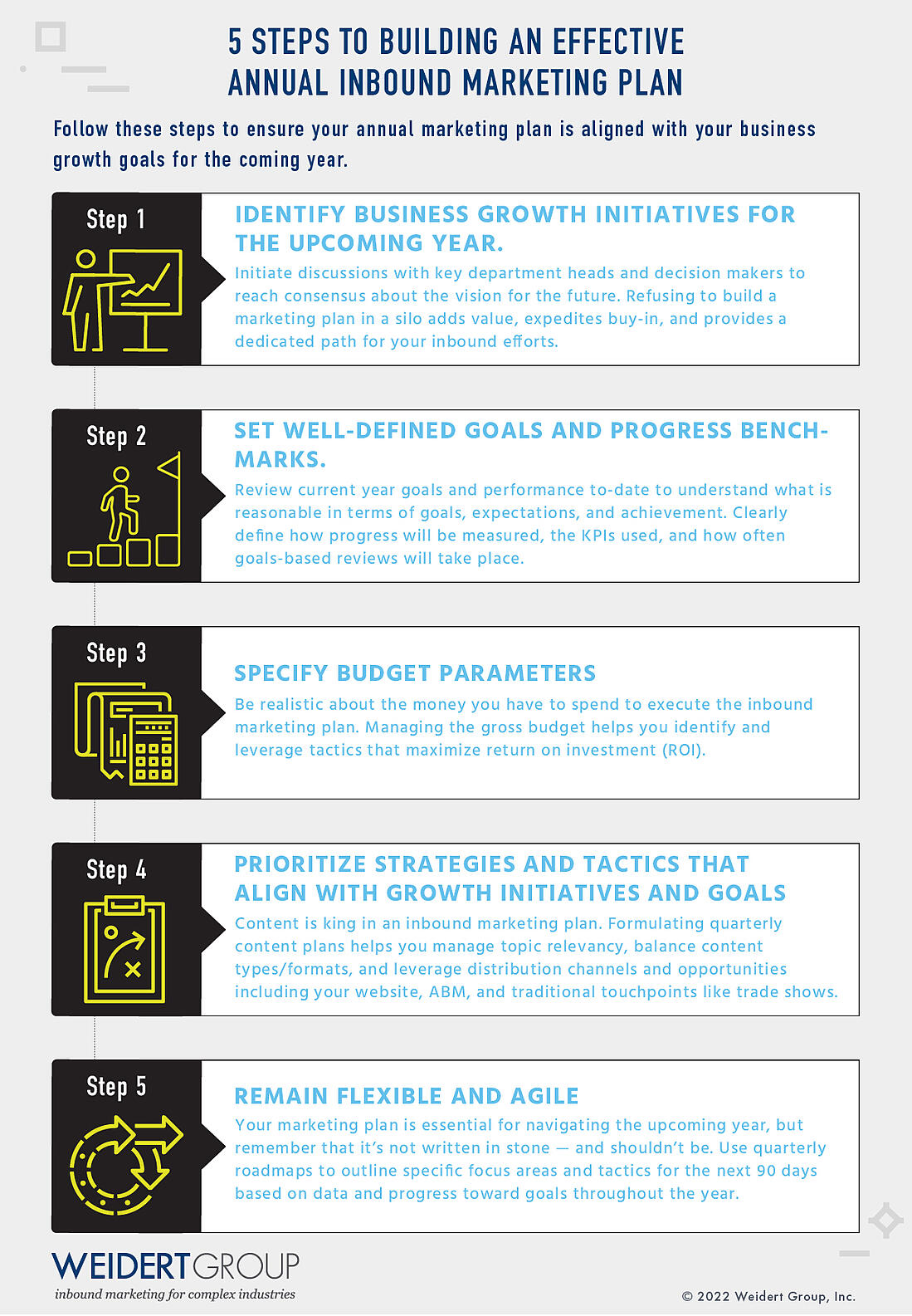

5 Steps to Create a 2023 Marketing Plan

Courtesy of Weidert Group – link here to details

Weidert also provides a free planning template available here.

MENTAL HEALTH

How EAPs are turning to technology to support employee mental health

From BenefitNews

Employers are finding ways with the help of innovative technology to put more help into employees’ hands (and minds!). What constitutes self-service in the counseling world? Everything from self-scheduling appointments and downloading meditation apps to engaging in digital self-help platforms and providing self-assessment data.

“Access is critical,” says Cecile Currier, CEO of Concern EAP, a Silicon Valley provider. “Studies show that it can take people weeks or months to get a therapist appointment. We eliminate those delays. We also simplified our platform and removed any friction points that might discourage someone who is probably already discouraged. It’s all about ensuring a seamless, high quality experience.” Learn more here.

A Third of Employers Still Aren’t Offering Mental Health Benefits

An opportunity for brokers?

From BenefitNews

Survey: 32% of HR pros say benefits partner is not proactive offering mental health benefits, 49% say benefits pros too infrequently establish a plan strategy.

A new survey by Uprise Health, a digital EAP provider, revealed that 35% of employers are not offering mental health and wellness benefits, and 43% of respondents say their employees are having a hard time accessing care, even when it’s offered. It will take a joint effort from both HR leaders and brokers to understand the business case offering mental health benefits to workers.

A good benefits partnership can help take the weight off of HR. The Uprise Health survey found that many HR leaders expressed dissatisfaction with their current broker relationships, with 32% saying their benefits partner has not been proactive in offering mental health benefits, and 49% saying they talk with their benefits professional too infrequently to establish a plan.

“We see an opportunity for the broker community to change how they engage and become more of a consultative partner as HR professionals are struggling to get out of the crisis reactive mode,” Mike Nolte, CEO of Uprise Health says. Dive deeper here.

FINANCE

New Financial Planning Process Empowers Clients, Saves Time

A trend toward collaborative financial planning, facilitated by sharing planning software onscreen via Zoom, is empowering clients and speeding up plan creation for advisors.

The gist: advisors need empathy “to be on the same side as the client” to understand their goals and values. Learn more here from ThinkAdvisor.

INDUSTRY NEWS

Optum and MemorialCare Update

Negotiations halt, resulting in lack of access for HMO patients

As of Nov. 8, Optum halted negotiations with MemorialCare for the HealthCare Partners and AppleCare medical group contracts expiring at the end of this year. Optum’s decision will limit their patients’ access to high quality healthcare at MemorialCare facilities close to home.

- As of Jan. 1, 2023, HMO members with HealthCare Partners and AppleCare Medical Group will not have access to non-emergency inpatient services at MemorialCare hospitals, including MemorialCare Long Beach and Orange Coast Medical Centers, as well as Miller Children’s and Women’s Hospital, or hospital-licensed outpatient services (e.g., surgery, imaging, radiation oncology, physical therapy, infusion therapy, and others).

- Optum’s decision to halt negotiations impacts HMO members only. PPO members who use Optum providers are not affected. In addition, only Optum medical groups, HealthCare Partners and AppleCare, are affected. Existing contracts between MemorialCare and other United Health Group subsidiaries (i.e., UnitedHealthcare, “UHC”) are not impacted, and MemorialCare will remain an in-network provider for UHC.

Please click here for a comprehensive brochure of MemorialCare network capabilities, should your clients want to learn more about ensuring their ongoing access to the highest possible quality of care at MemorialCare facilities.

Questions? Contact Cathy Capaldi, SVP at ccapaldi@memorialcare.org.

IS CMS RECORDING RULE CAUSING YOU ISSUES? LET US KNOW.

To share your experience, please respond to CalBroker’s survey: “Call Recording: How Was Your Experience.”

Here’s the QR code to our very brief 4–question survey. Or you can link here to download and email questions to publisher@calbrokermag.com.

No Cost Recording Solution Available from MedicareCENTER.com

Agents and brokers who need a smart and efficient way to stay compliant can use the MedicareCENTER’s Call Recording program. It’s easy to seamlessly record all sales calls, store the recordings compliantly and download calls at any time, from anywhere. Available at no cost at medicarecenter.com/welcome

ACCOLADES!

OCAHU recently won the Outstanding Philanthropic Group for Orange County on National Philanthropy Day

GREAT Work OCAHU members!

GREAT Work OCAHU members!

INDUSTRY CALENDAR

2022 WEBINARS

- Dec. 1, 11:30 – 1:30 pm PST: WIFS: Tax Year In Review and What’s Coming in 2023. Contact Janet Fishman: janet@wifs-losangeles.org

- Dec. 6, 10 am PST: JorgensenHR free Labor Law Update webinar. Register.

- Goldmine! Guardian Life + Spring Health Mental Wellness Webinar Series. Online live, and on demand. Next up: Dec. 14, 9 am PST, Grief & Loss: Productively processing strong emotions. Register

2022 CONFERENCES

- Dec. 1, EBRI 2022 Retirement Summit, Washington D.C. Online & in person. Register

- Dec. 19-21, Money 2.0 Conference, White Wing CEO Joshua Schneeloch will present along with other experts. Las Vegas. Details

2023 EVENTS

- Jan. 24, 10:00 AM to 1:00 pm PST, NAHU Live Virtual Corporate Wellness Certification. Register

- Feb 5-8, 2023 You Powered Symposium hosted by E-Powered Companies, Miami, Florida

An event for Bold Benefits Trailblazers. Register. One of the speakers is our own contributor Dawn McFarland! - Feb. 23, 11:30 am – 1:30 pm PST by Zoom, 70th Annual Will G. Farrell Award & Leadership Recognition Event, sponsored by NAIFA-LA and FSP. Info: janet@wifs-losangeles.org

- Mar. 4, 9:00 am to 1:30 pm PST, by zoom: WIFS-LA Women’s Forum “Embrace Empowerment” Early Registration Discount thru Dec. 31, 2022. Info: janet@wifs-losangeles.org

- March 13-15, Ellevate Women’s Leadership 2023 Summit, JW Marriott just outside Las Vegas. Register here.

- May 8-10, 2023 CAHIP Capitol Summit, Sacramento. Info.

Look for December Print Magazine in your mailbox soon.

To subscribe, email zulma@calbrokermag.com.