The 2023 CHCF California Health Policy Survey

California is home to nearly 40 million people of different incomes, ages, and racial and ethnic backgrounds, and who live in different regions. Every year since 2019, the California Health Care Foundation has conducted a representative, statewide survey of residents’ views and experiences on a variety of health care topics, some of which are tracked to detect meaningful shifts over time.

Key findings from this year’s survey include:

Health care costs. Like prior years, half of Californians (52%) report skipping or delaying health care due to cost in the past 12 months. Of those who skipped or delayed care, half of them (50%) say their condition got worse as a result.

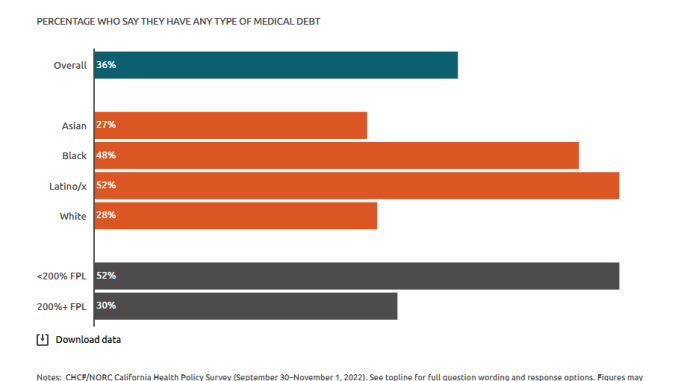

Medical debt. More than 1 in 3 (36%) report having medical debt, and of those, 1 in 5 (19%) report owing $5,000 or more. Californians with lower incomes (52%) are more likely than those with higher incomes (30%) to report medical debt.

The full report, available here

MEDICARE

Sponsored by AGA

Primary Care Hot Topic

CVS spends big money on Oak Street Health clinics

Big money is pouring into primary care clinics as the nation’s health care giants hunt for ways to cut costs by keeping people healthy. CVS Health said that it will spend about $10.6 billion to buy Oak Street Health, which runs clinics that specialize in treating Medicare Advantage patients. Founded in 2012, Oak Street operates 169 locations in 21 states. It expects to have more than 300 locations by 2026.

The acquisition comes just three months after a nearly $9-billion investment by rival Walgreens in VillageMD’s acquisition of the urgent and primary care chain Summit Health-CityMD. And that deal was announced two months after CVS said it would spend $8 billion to acquire home health care provider Signify Health. Read more here:

Emergency Room Turns Simple Injury Into a Big Bill

Leigh Fava wound up in the emergency room after injuring her thumb at her New Orleans home. She said she received a tetanus shot and a badly wrapped bandage — and an unexpectedly high bill. Her experiences trying to dispute the hospital’s charges left her feeling ignored, she said. Watch or read here

New Bill Would Change Social Security Claiming Age Terminology

New legislation would change the Social Security Administration’s benefits statement terminology from “early eligibility age,” “full retirement age” and “delayed retirement credits” to “minimum benefit age,” “standard benefit age” and “maximum benefit age” to better reflect Social Security’s claiming design and how the program works.

The bill, S 664, introduced Monday by Sen. Bill Cassidy, R-La., is co-sponsored by Sens. Chris Coons, D-Del.; Susan Collins, R-Maine; and Tim Kaine, D-Va.

The bill also requires the SSA to mail Social Security statements every five years to account holders between the ages of 25 and 54, every two years for those between the ages of 55 and 59, and annually for those 60 and above. Read more

COMPLIANCE

Sponsored by Word&Brown

Important Licensing CE Change for California Agents –

Fraud-Prevention Ethics Training

By Paul Roberts

The California Department of Insurance (CDI) recently changed its Ethics Continuing Education (CE) requirements for licensed health insurance professionals in the state. Agents are still required to earn at least three hours of Ethics CE training to renew a license; however, under the new requirements, one of those hours must now focus entirely on fraud prevention.

The CDI has developed its own one-hour CE course to satisfy this requirement. Taking the CDI course is the only way to earn this hour of CE.

Read California Broker’s March article here

Happy International Women’s Day (IWD)

Every year, March 8 is observed globally as International Women’s Day (IWD) to celebrate the achievements of women. Education is the precursor of women’s empowerment. We would like to share how JESSICA WORD CEO of Word & Brown General Agency cultivates a culture of mentorship in our October 2022 issue. Read article here

HOT PRODUCT FOR CALBROKER READERS: eMagazine

Digital Plus Print Make Cal Broker the Top Choice for Life and Health Brokers in California

Many of you may not know that as the owner of California Broker Media, I come from 25 years on the agency side. Since June of last year, my editorial focus has been to view the content of articles submitted by industry experts using a filter that ensures we offer the most valuable and relevant information to California brokers of life and health insurance.

California Broker Magazine will soon also come to our email subscribers as an eMagazine. We will make the eMagazine available on our website as usual AND we will also email it our monthly subscribers as well. Please give both formats a chance. If you want to unsubscribe to the eMagazine, you may do so.

Please know the print magazine will continue to be mailed to subscribers.

Digital and Print: Note that the eMagazine has the same content as the print.

The new eMagazine digital version will be accessible on all media forms: mobile phone, laptop and desktop.

Subscribe to get this months issue in your inbox:

www.calbrokermag.com/digital-subscriber/

Average American Expects to Retire Early: Survey

Most Americans plan to retire, and those who do plan to do so expect to leave full-time work a decade earlier on average than full retirement age, according to a new survey from NerdWallet, a personal finance company. Others say they will never retire because they want to keep working or they do not feel they will financially be able to quit.

The Harris Poll conducted the survey in early January among 2,079 U.S. adults. Further read here

INFOTECH

Work phones are making a comeback as offices ban more social media apps

There may be a new ringtone in your life — the urgent chime of a company-issued cell phone.

In a throwback to the BlackBerry era, telecom-service providers are seeing strong growth from companies handing out phones to employees. The phenomenon, which started during the pandemic, picked up recently thanks to new compliance policies around the use of WhatsApp and TikTok.

The phones are more than just a corporate perk, said Gartner analyst Lisa Pierce.

“It’s also about control” — a means of restricting or blocking applications and keeping corporate data secure, she said.

Businesses, especially those in finance, have grown concerned about the security of their data, and the Securities and Exchange Commission and the Commodity Futures Trading Commission have stepped up their scrutiny over unauthorized private communication on applications such as WhatsApp and through personal email. Read more

EXIT PLANNING

Sponsored by Strazzeri/Mancini

“Special Offer to Learn Succession Planning to help your Group Health Clients”

As a Basic Member you will have special alerts and access to live events such as Thursday Insights, Community Insights, and select recordings.

Here is the link to the Southern California Institute (SCI) Basic Membership (normally $49/month):

https://sciacademy.socialjack.com/product/basic-membership/

For California Broker readers, membership is free when you enter Calbroker23 in the coupon code field and complete the checkout process.

For additional information please contact:

Shelley Lightfoot

Executive Director

Email: sl@scinstitute.org

858-200-1900

BROKER RESOURCES

6 Common Mistakes Insurance Brokers Should Fix for 2023

Take time to reflect on what you learned in 2022

By Tom Avery

For most people, the new year is about looking forward. For insurance brokers, it’s time to breathe a sigh of relief now that the madness of Q4 is done — and you can finally take that well-deserved rest.

Not so fast!

Before you leave 2022 behind, it’s important to take time to reflect on what you learned to prepare for success in the new year. How successful Q4 2023 is will depend on your work in the three other quarters leading up to open enrollment.

In the spirit of reflection, here are the top mistakes brokers made last year that might have lost them clients—and how they can avoid making those same mistakes this year. Continue reading article here:

INDUSTRY CALENDAR

- March 31, 10:30 AM PST, White Wing Insurance National Meeting to announce a new partnership with UnBlinded Co-Founder Sean Callgay

Learn more here: https://www.whitewinginsurance.com/unblinded Register here. - April 10, 9:30 am PST CAHIP Orange County 26th Annual Charity Golf Classic. Contact CAHIP-OC at (714) 441-8951, ext. 3 or at orangecountyahu@yahoo.com

CONFERENCES

- March 13-15, Ellevate Women’s Leadership 2023 Summit, JW Marriott just outside Las Vegas. Register

- April 11-14, Virtual Fourth National Medicare Advantage Summit by Global Health Care, Virtual/Online Live Video; Media Partners: Harvard Health Policy Review, Health Affairs and Inside Health Policy. Contact: (800) 503-0078. Registration@hcconferences.com, Register

- May 8-10, CAHIP Capitol Summit Sacramento. Registration is NOW OPEN. Register Here