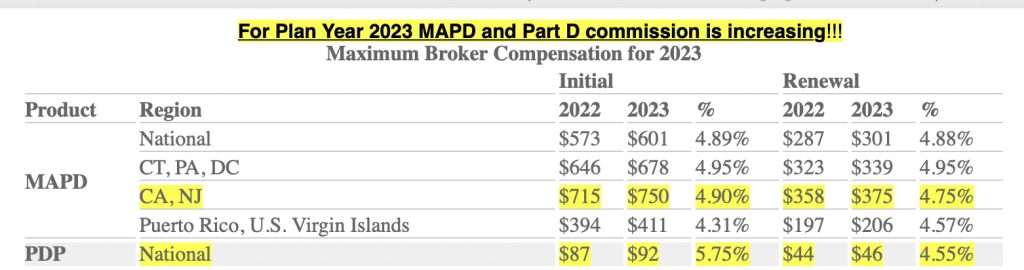

Brokers enrolling clients from California will receive a nearly 5% increase in Medicare MAPD and Part D commissions in 2023. Look forward to this reward for your hard work.

For details click here.

MEDICARE

Medicare Turns a Profit! Hurray!

COVID-19 gave the U.S. Medicare Part A hospitalization program a big financial boost in 2021. Because enrollees minimized use of ordinary hospitals, spending on benefits plunged. That drop in spending on hospital bills gave Medicare Part A $8.5 billion operating profit in 2021 on $337 billion in revenue, according to the new Medicare Trustees Report. That compares with a loss of $60 billion on $342 billion in revenue in 2020. Now, the trustees are predicting that the trust fund will last until 2028, but that operating revenue will cover just 90% of program costs in 2028.

That means: If past trends continue, the program solvency issues may be more likely to lead to big changes in life insurance, annuity, retirement savings program, estate tax and general income tax rules, at some point between now and 2027, than to lead to dramatic changes in the Medicare program.

Chiquita Brooks-LaSure, the administrator of the Centers for Medicare and Medicaid Services (CMS), the agency that oversees Medicare, said in a written comment about the Medicare Trustees Report that Medicare needs to continue to provide high-quality, person-centered coverage.

“Medicare trust fund solvency is an incredibly important, longstanding issue and we are committed to working with Congress to continue building a vibrant, equitable, and sustainable Medicare program,” Brooks-LaSure said.

Read more.

RETIREMENT

CalSavers Reminder: June 30 deadline looms

The State of California has grown increasingly concerned about Californians’ lack of retirement savings. To help combat this, the state created the CalSavers retirement savings program.

Health benefits professionals who have clients with businesses of five or more employees in California will be required to offer a retirement savings plan by June 30, 2022. Are you prepared? Know that employers have a 90-day grace period.

To properly advise your clients, read more in CalBroker:

“CalSavers MANDATE — How to Turn a Problem into an Opportunity.”

HEALTHCARE

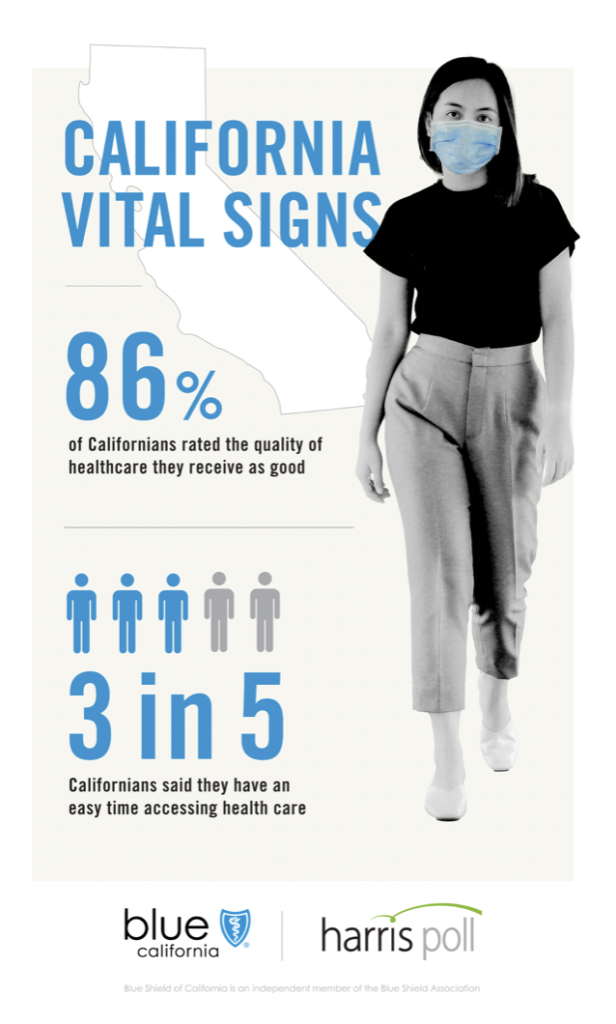

“Health Care is Improving” say Californians

“Health Care is Improving” say Californians

Blue Shield Vital Signs poll reveals positive outlook

An increasing number of Californians are feeling positive about health care, even as the COVID-19 pandemic continues, according to a new poll commissioned by Blue Shield of California. The poll of 1,000 Californians was conducted in February of this year. Read more.

Address health problems before they start

Chronic disease is on the rise and screaming to be addressed. Exacerbated by the COVID-19 pandemic, preventing disease rather than reacting to it is called for, writes Newtopia Inc.’s Lara Dodo. Preventive treatment, including programs in genetic testing, personal coaching and nutrition, can help populations be happier, healthier and more productive, Dodo said. Read more.

INSURANCE

Hospitalization Insurance Global Market Report now available

It makes sense that the demand for health insurance policies has seen a massive spike during the coronavirus pandemic, making individuals more conscious of the value of buying health insurance. This is also fueling the growth of the hospitalization insurance market from $88.56 billion in 2021 to $101.91 billion in 2022 at a compound annual growth rate (CAGR) of 15.1%. The market is expected to grow to $153.27 billion in 2026 at a compound annual growth rate (CAGR) of 10.7%.

As a result, Research and Markets has produced the Hospitalization Insurance Global Market Report 2022. The hospitalization insurance market consists of sales by entities engaged in directly underwriting hospitalization insurance policies providing coverage for hospital confinement due to illness, accidents, intensive care of convalescence.

Expansion of Telehealth and Mental Health Funding

The Integrated Health Policy Consortium (IHPC) is looking ahead to 2023, when Congressional priorities will be centered on evaluating initiatives established during the pandemic that were successful and worth keeping. Two key areas of interest to IHPC and Partners for Health for the post-pandemic public health agenda is the expansion of telehealth programs and funding for mental health. Read more.

Telehealth Expansion

“Leaning into Whole Health: Sustaining System Transformation While Supporting Patients and Employees During COVID-19.” This paper describes the beneficial impact on the Veterans Administration Whole Health Program from the shift to telehealth. Read the paper here

Mental Health Funding

“Pain in the Nation: The Drug Alcohol and Suicide Crisis and Need for National Resilience Strategy.” This report from Trust for Americas Health examines the set of epidemics the country is facing and includes evidence-based programs and policies to address these triple crises. Read the report here.

COMPENSATION

Broker Compensation – Ethical or borderline?

Are the countless incentives offered preventing brokers from what would ordinarily be annual due diligence? Are they placing business where producers are better off instead of selling the solution their client actually needs?

“Along with where the money is coming from, a larger question is brewing among those in our community: Is it unethical for advisers to be paid more every year if they deliver poorer results?”

Explore this ethical dilemma with Emma Fox in Employee Benefit News.

FINANCE

How Inflation Can Affect Your Clients

ThinkAdvisor.com offers solutions

Be informed: A continued high inflation rate could push the prices of many goods and services out of the reach of many consumers. Lower consumer demand could adversely affect revenue and profits of many companies and ultimately affect their stock price. Investments, Social Security and Retirement funds are all affected.

Be ready to guide clients: Be sure to discuss the potential impact of inflation on their financial situation with them. They will be looking to you for planning suggestions to help navigate through this current bout of inflation combined with high interest rates.

EVENTS

- iSolved Webinar: “Debunking the Top ACA Myths” June 21, 11 a.m. PST / 2 p.m. EST. Register here.

- NAHU Power Hour: A moment with Mordo, June 22 3:30 p.m. PST / 6:30 p.m. EST with Employee Benefits Advisor Jolene Bryant and David Mordo, senior compliance officer at BenefitMall. Register here.

- Aetna Client Series webinar: “Reimagining Workforce Strategies” June 23 at 11 a.m. PST/ 2 p.m. EST Register here.

- NAHU 2022 Annual Convention: “The Power of Story” June 25-28, Austin, Texas. Info here.

- CAHIP Engage, Statewide Leadership Conference, July 18 & 19, Universal City, Calif. Register here.

- IEAHU, OCAHU & SDAHU Senior Summit, Aug 23-25, Pechanga resort, Temecula, Calif. Information here. Register here.