Understanding Medicare Is a Must for Group and Individual Agents and Brokers

Understanding Medicare Is a Must for Group and Individual Agents and Brokers

by Margaret ‘Maggie’ Stedt, LPRT, C.S.A. • Too many agents and brokers are not educating themselves and their clients about Medicare eligibility. This may create coverage delays and lifetime penalties.

Five Selling Points to Close More Medicare supplement Deals

by Bill Haynor • Many agents will dive into Medicare coverage and cost options, but that’s not where to start with a prospective policyholder.

Medicare Part D Could Be Just What the Doctor Ordered

by Melissa Homa • Approximately 10,000 people turn 65 and become eligible for Medicare every day, and most beneficiaries have the need for Part D coverage.

There is an overwhelming number of Part D plans available that insurance agents in the senior market can capitalize on and use as an effective door opener.

Helping Your Self-Funded Clients Manage Specialty Drug Costs

by David Zanze • Specialty drugs can present unique challenges for self-funded plans.

Pros and Cons of Life Settlements as Retirement Costs Grow

by Stephen Terrell • While life settlements may not be right for every person with life insurance, all consumers should know about the option.

Voluntary Benefits– The Bright Side of the Road, What the Determined-To-Succeed Broker Should Know

by Ron Fields • There are seven clear reasons to remain committed to a career in the broker industry and seven clear reasons to anticipate success.

COBRA Compliance Best Practices

by Sara Flowers • COBRA has been around since 1985 and continues to be a small, but very important aspect of the employee benefit world. COBRA involves liability, notices, timeframes, eligibility monitoring, and regulation changes.

The Coming of Age for Defined Contribution

by Ron Goldstein, CLU • With a hardy push from Healthcare Reform, America now sits on the precipice of a massive transition to defined contribution.

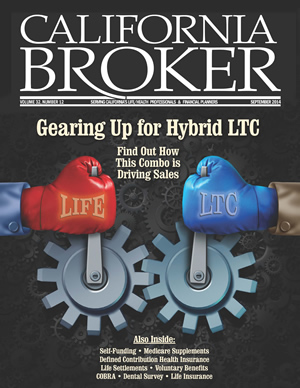

Long-Term Care & Life Combo – Selling Long-Term Care: Uncovering the Benefits to a Life Insurance Policy

by Ray Kathawa • Many financial professionals argue that life insurance riders offer limited coverage and that they are not adequate planning tools. These objections can be best

addressed by walking through a typical client scenario.

Long-Term Care: Self-Insure if You Can

By Gene A. Pastula, CFP • Find out why linked benefit products have been a solid, successful alternative strategy that provides predictable results and peace of mind. They are a fundamental asset in any portfolio.

Dental Survey – You Know the Drill: Our Annual Dental Survey

Welcome to California Broker’s 2014 Dental Survey. We’ve asked the top dental providers in California to answer 28 crucial questions to better help you, the agent, understand their benefits, features and services. Read the responses and sell accordingly.

Life Insurance Sales – It’s Time to Disturb Your Clients

by Allan D. Gersten • More often than not, it takes a hard-hitting message to help clients meet their challenges.

The message may be disturbing, but it will never be nearly as distressing as failing to do our very best for every client.