The Scoop on MEDICARE

Medicare Parts A & B Premiums Reduced! Hip Hip Hooray!

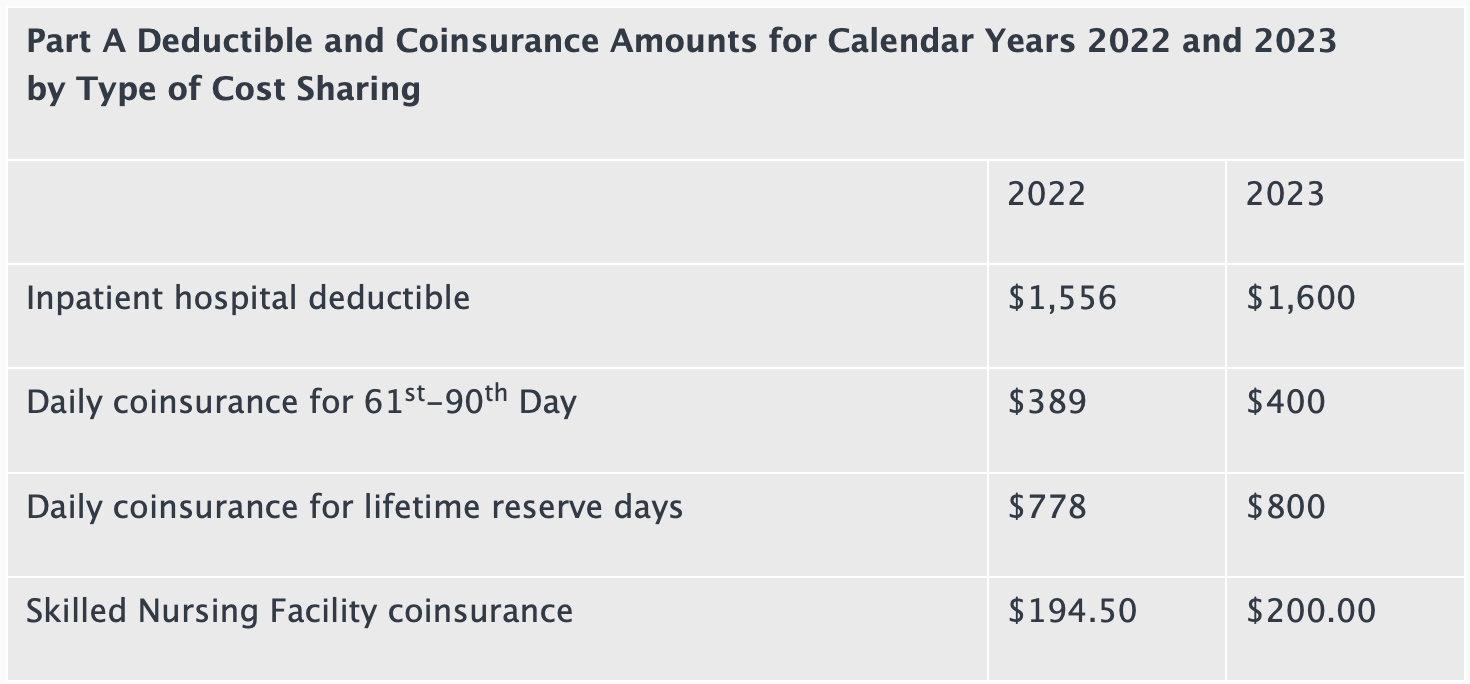

On Sept. 27, the Centers for Medicare & Medicaid Services (CMS) released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts.

The standard monthly premium for Medicare Part B enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022. The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022.

Full CMS announcement.

Medicare changes for 2023: What you need to know

Medicareresources.org offers insights ahead of open enrollment, which begins Oct. 15

“There are some positive changes for beneficiaries in 2023, including lower-cost insulin and additional free vaccines,” said Louise Norris, a health policy analyst for medicareresources.org. “Consumers can also expect changes to cost sharing and premiums, which can impact their out-of-pocket costs.”

Here are four important things to know:

- Insulin costs will be capped at $35 a month

- Recommended vaccines will be free

- Amid inflation, some costs will decrease

- Medicare Advantage enrollment expected to grow

Don’t Get Caught Off Guard

Be ready to comply Oct. 1 to CMS Medicare Marketing Rule

Be prepared to follow the rules to the best of your ability until Centers for Medicare and Medicaid Services (CMS) gives clear guidance, or notice that the rule is delayed for further consideration. NAHU and their Medicare Advisory teams are on the ground and pushing back on CMS. They are planning to host a nationwide webinar when they get official guidance from CMS. Since that may be AFTER Oct. 1st, the best advice is to err on the side of caution as you prepare to comply with the rule beginning Oct. 1st. Read more.

Remind your clients! Medicare Part D notices due Oct. 15

Medicare requires group health plan sponsors to disclose to individuals who are eligible for Medicare Part D and to CMS whether the health plan’s prescription drug coverage is creditable. Plan sponsors must provide the annual disclosure notice to Medicare-eligible individuals before Oct. 15 — the start date of the annual enrollment period for Medicare Part D. Because employers may not know whether covered spouses are nearing the age of Medicare eligibility, the notice should be sent out to all employees. Details here.

FFS Medicare 7% More Expensive than MA plans

An analysis of 2019 CMS spending data showed spending by Medicare Advantage (MA) plans was about 7% lower than traditional Medicare spending for similar care, resulting in billions of annual savings for taxpayers. Full Story: Becker’s Payer Issues

Weathering the reform storm: The Inflation Reduction Act’s changes to Medicare and other healthcare markets

Take a look at drug pricing and other healthcare-related changes in the Inflation Reduction Act, including:

- Key healthcare provisions of the act

- Potential implications to stakeholders within the healthcare and pharmaceutical sectors

- Next steps and a timetable of changes in the coming years

NCQA releases health plan quality ratings for 2022

The National Committee for Quality Assurance (NCQA) released its 2022 quality ratings for commercial, Medicaid and Medicare health plans, based on member experience, quality of patient care and efforts to keep improving. A total of 1,048 plans received a rating, but only six got a perfect rating of 5 stars.

Details here: Becker’s Payer Issues, HealthLeaders Media

See all plan ratings here.

“The ratings are a way for consumers to hold the industry accountable and for families to choose plans based on their individual needs,” said NCQA’s Andy Reynolds.

CalMatters: Medi-Cal Providers Fear Disruption To Patient Care

More than 1.7 million Medi-Cal patients may get a new insurance provider in the coming months as a result of the state’s first-ever competitive bidding process, but critics and some providers fear the change will cause major disruptions to care. Read more.

OPEN ENROLLMENT NEWS

Scrap autopilot mode during open enrollment

This time of year, most benefit advisers are on autopilot. An article published by Verywell Mind offered some interesting insight when it suggested that “the ability to act without really thinking happens when a behavior becomes over-learned.”

“If you are an adviser on autopilot, then stop it. Simply shopping the renewal to the same cast of characters, none of whom have a vested interest to save anyone money, and passing on more cost to employees to lower cost is simply unacceptable. It’s also downright inconsiderate and lacking in empathy. As someone whose family had to file bankruptcy because of medical expenses (which I detailed in my previous commentary), I know what it’s like to be on the receiving end of madness.” Lester J. Morales

YOUR HEALTH

Doctors Say “Stay Well: Get Your Flu Shot Soon!

This year’s flu season may be a tough one, doctors warn.

Higher rates of flu cases in Australia and fewer Covid-related precautions may portend a rocky season in the U.S. Read details here.

MENTAL HEALTH

Good for your head

Mental Health Support Increasing

No surprise here! 32.8% of people reported symptoms of depression or anxiety, up from 11% in 2019. This according to a Kaiser Family Foundation analysis of June 2022 U.S. Census data. The demand for more accessible mental health support is urgent and growing. And employer-provided health plans, which cover more than half of Americans, offer vital services to those in need of support and counseling.

In fact, 41 million people — nearly 1 in 4 Americans — received mental health support through their employer-provided coverage in 2020. That includes 6 million children who received mental health services and treatment through a parent or guardian’s employer plan. Read more. Access AHIP Info graphic here.

FINANCIAL HEALTH

Purchasing Power® Introduces Enhanced Set of Financial Wellness ServicesDesigned to Provide Immediate Support to Under-Resourced Portion of Employees

Employee financial stress can impact the employers’ bottom line through increased healthcare coverage costs, loss of productivity and employee retention rates.

- Almost one-third (29%) of employees took a job at a new company/organization in 2021. Four in five (80%) say benefits that their employer offers impact their decision to stay at their current job.

- Almost three-fourths (72%) believe that employers have a responsibility to help employees with their financial well-being.

Read announcement.

For more information on Purchasing Power’s Financial Wellness services, click here.

ORAL HEALTH

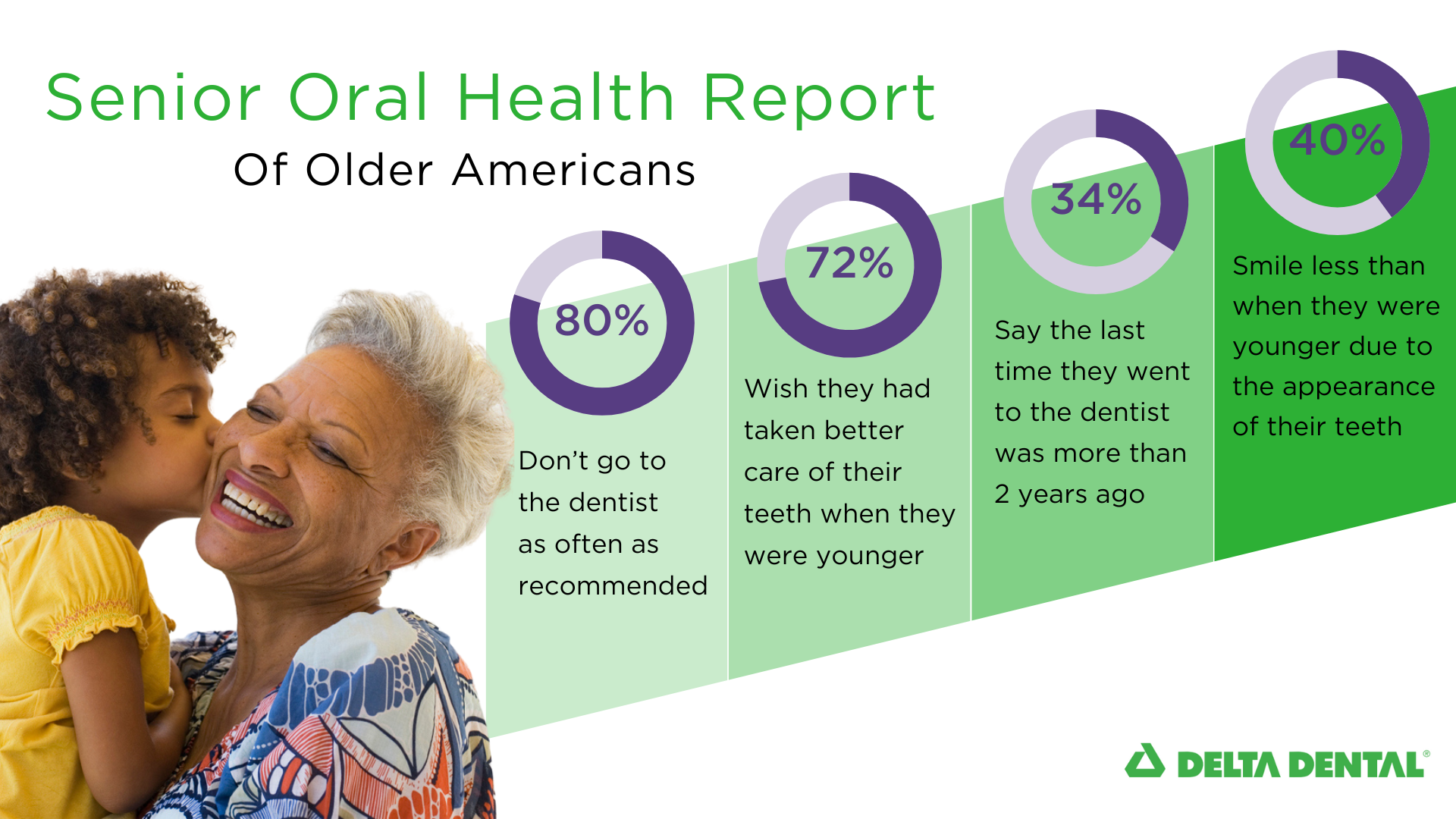

Older Americans Regret Not Caring for Their Teeth More in Youth,

But 80% Still Aren’t Doing So

Delta Dental’s Senior Oral Health Report examines the barriers to and negative impacts of not caring for our oral health as we age.

The Delta Dental Community Care Foundation, the philanthropic arm of Delta Dental of California, today announced a $1.67 million grant to the UCLA School of Dentistry’s Community-Based Clinical Education Program. The grant, the Community Care Foundation’s largest ever, will be used to establish the UCLA Dentistry MINDFUL Project, which stands for mobile care in dentistry for underserved populations living in long-term care facilities, to address the urgent need for comprehensive oral health care and education among seniors and special needs populations. This funding is part of Delta Dental’s multiyear commitment to improving the lives and well-being of older adults, especially those of color or living in poverty, or whose mobility issues prevent them from receiving oral health care. Access here.

WHO’S WHO

Delta Dental Leadership Changes

Get the details of Delta Dental of California’s leadership structure updates, including the appointment of Sarah Chavarria as president. Read more.

MERGERS & ACQUISITIONS

Judge Rejects Antitrust Challenge to UnitedHealth Change Acquisition

Ruling deals blow to Biden administration enforcement and clears health giant to buy health-technology firm Change Healthcare

The case hinged on how the acquisition would affect two technologies that are vital to processing payments for medical services. Details here.

DOJ’s case against UnitedHealth’s Change buy was hampered by ‘serious flaws,’ judge finds

The most serious flaws were failing to prove that UnitedHealth is likely to misuse Change Healthcare’s data to advantage the company, Judge Carl Nichols wrote.

After a thorough trial that lasted more than two weeks, included more than two dozen witnesses and tallied more than 1,000 exhibits, the DOJ failed to prove the transaction is likely to substantially lessen competition, Nichols said in his opinion. Details here.

GOOD NEWS

Happiness Break: Six Minutes to Connect with Your Body

Dedicating a little time to tune into your body fortifies you to better handle the stresses of daily life. Click here

CALENDAR

WEBINARS

- Oct. 4, 11:00-12:00 pm PST – Custom Media Digital Health Free Webinar: “Accelerating Healthcare’s Digital Evolution: A roadmap to Enterprise Intelligence” Register

- Oct. 4, 1:00-2:00 pm PST – CAHU: PEO 101 “When Professional Employer Organizations Can Best Resolve Clients Benefits, Risk, Compliance, HR and Payroll Needs.” Register.

- Oct 4, 3:00-4:00 pm PST – Freed Associates: Health Equity and Health Plans – A Way Forward. Hear experts from Anthem, Inland Empire Health Plan and SameSky Health discuss how health plans are stepping up as health equity leaders. Register.

- Oct 6, 11:30-12:30 pm PST – Dickerson Insurance Services: Dave’s Corner: Health Benefit Captives for Mid-Sized Employers. Register.

- Oct. 13, 9:00-5:00 pm PST – NAIFA Fall Conference: Continuous Connections. Retirement Planning Strategies, Digital Marketing and more. Register.

- Oct. 18, 12:00-1:15 pm PST – GGAHU Complimentary Webinar “Transparency: No Surprises!” ACA and CAA’s No Surprises Act, presented by the Word & Brown General Agency’s Sr. Director of Education, Paul Roberts. Register.

CONFERENCES

- Oct. 5-7, National African-American Insurance Association (NAAIA) 2022 Annual Conference & Empowerment Summit, Baltimore, MD. Info here

- Oct. 9-11, Self Insurance Institute of America (SIIA) ENGAGE National Conference & Expo, Phoenix. Info: 800-851-7789 www.siiaconferences.org

- Oct. 16-18, Life Insurance Marketing and Research Association (LIMRA) 2022 Annual Conference, Chicago. Register

- Nov. 13-16, HLTH 2022 Health Innovation Expo, Las Vegas. Register

- March 13-15, 2023, Ellevate Women’s Leadership 2023 Summit, JW Marriott just outside Las Vegas. Register

CALIFORNIA BROKER Print Magazine: October issue will be out first week of October. Look for the features on:

Women in Leadership through Mentoring by Jessica Word

Resilience and Health: In response to life’s adversity, how effectively do you bounce back? By Dr. Mark Pettus, MD.

Sign up for a monthly print subscription by sending your physical address to: Calbrokermag@calbrokermag.com

Advertisers & Authors Wanted!

Spots still available in Nov & Dec 2022.

Contact editor@calbrokermag.com